Home Buying Gets Easier as Down Payments Dip

One hurdle to first-time homebuyers is starting to get a little lower: The average down payment for a home fell to less than 15 percent in the first quarter of 2015 to its lowest level since early 2012. The average down payment for the quarter was $57,710, according to RealtyTrac.

The lower down payments reflect new loan programs recently introduced by Fannie Mae and Freddie Mac, and lower insurance premiums for Federal Housing Authority Loans. The market is also adjusting as large, institutional investors who had been buying starter homes as rental investments dial back.

Related: U.S. Homeownership Dips, But Household Formation Rises

“Down payment trends in the first quarter indicate that first-time homebuyers are finally starting to come out of the woodwork, albeit gradually,” RealtyTrac vice president Daren Blomquist said in a statement.

Broken down by type of loan, the average down payment for conventional loans was 18.4 percent ($72,590), and the average down payment for FHA loans was just 2.9 percent ($7,609). FHA loans as a share of all mortgages increased from 21 percent in January to 25 percent in March.

Among the country’s largest counties, Wayne County in Detroit, Mich., had the lowest average down payment (12 percent), and New York had the highest (37 percent).

While lower down payments are good news for first-time homebuyers, they also are a reminder of practices that led to the housing bubble that began to burst in late 2006 and contributed to the financial crisis. During the height of the boom, buyers were able to purchase homes that they couldn’t really afford by putting little or no money down on the property.

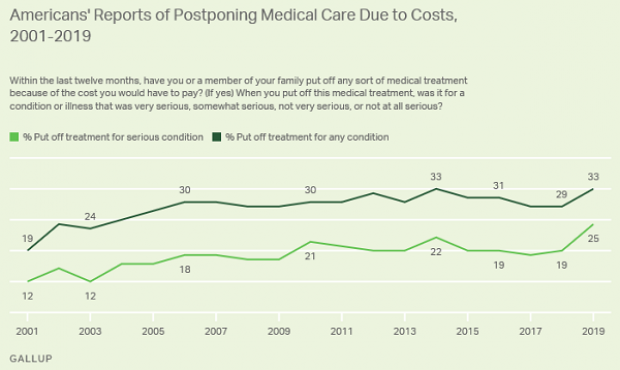

Increasing Number of Americans Delay Medical Care Due to Cost: Gallup

From Gallup: “A record 25% of Americans say they or a family member put off treatment for a serious medical condition in the past year because of the cost, up from 19% a year ago and the highest in Gallup's trend. Another 8% said they or a family member put off treatment for a less serious condition, bringing the total percentage of households delaying care due to costs to 33%, tying the high from 2014.”

Number of the Day: $213 Million

That’s how much the private debt collection program at the IRS collected in the 2019 fiscal year. In the black for the second year in a row, the program cleared nearly $148 million after commissions and administrative costs.

The controversial program, which empowers private firms to go after delinquent taxpayers, began in 2004 and ran for five years before the IRS ended it following a review. It was restarted in 2015 and ran at a loss for the next two years.

Senate Finance Chairman Chuck Grassley (R-IA), who played a central role in establishing the program, said Monday that the net proceeds are currently being used to hire 200 special compliance personnel at the IRS.

US Deficit Up 12% to $342 Billion for First Two Months of Fiscal 2020: CBO

The federal budget deficit for October and November was $342 billion, up $36 billion or 12% from the same period last year, the Congressional Budget Office estimated on Monday. Revenues were up 3% while outlays rose by 6%, CBO said.

Hospitals Sue to Protect Secret Prices

As expected, groups representing hospitals sued the Trump administration Wednesday to stop a new regulation would require them to make public the prices for services they negotiate with insurers. Claiming the rule “is unlawful, several times over,” the industry groups, which include the American Hospital Association, say the rule violates their First Amendment rights, among other issues.

"The burden of compliance with the rule is enormous, and way out of line with any projected benefits associated with the rule," the suit says. In response, a spokesperson for the Department of Health and Human Services said that hospitals “should be ashamed that they aren’t willing to provide American patients the cost of a service before they purchase it.”

See the lawsuit here, or read more at The New York Times.

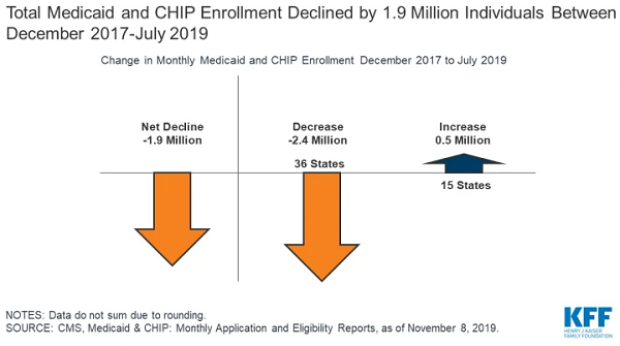

A Decline in Medicaid and CHIP Enrollment

Between December 2017 and July 2019, enrollment in Medicaid and the Children's Health Insurance Program (CHIP) fell by 1.9 million, or 2.6%. The Kaiser Family Foundation provided an analysis of that drop Monday, saying that while some of it was likely caused by enrollees finding jobs that offer private insurance, a significant portion is related to enrollees losing health insurance of any kind. “Experiences in some states suggest that some eligible people may be losing coverage due to barriers maintaining coverage associated with renewal processes and periodic eligibility checks,” Kaiser said.