Obama Says King v. Burwell Is an ‘Easy Case’

House Republicans are gearing up to grill Health and Human Services Secretary Sylvia Mathews Burwell this week over how the administration will handle any potential fallout if the Supreme Court strikes down federal subsidies for health insurance coverage in 34 states operating on the federal exchange. Burwell will testify before the House Ways and Means Committee on Wednesday, ahead of the high court’s ruling in the high-stakes case of King v. Burwell, expected later this month.

The plaintiffs in that case contend that the law’s language only provides for subsidies to people in states that created their own exchange. The Obama administration and authors of the law maintain that the law was intended to offer subsidies to all enrollees who are eligible based on their income regardless of which exchange they used.

Related: If Obamacare Collapses, These 9 Ideas Could Save Health Care

If the court rules against the administration, an estimated 6.5 million people could lose their subsidized health coverage. If that happens, experts say it could create a ripple effect throughout health insurance markets in federal exchange states. Nearly everyone agrees that such a ruling would be devastating for millions of Americans. However, there is little agreement over what, if anything, to do to stem such fallout if the court rules for the plaintiffs.

Asked why his administration has given little guidance to states on how to prepare for the potential loss of federal insurance subsidies, President Obama on Monday said, “there is no reason why the existing exchanges should be overturned through a court case.”

King v. Burwell “should be an easy case,” Obama said. “Frankly, it probably shouldn’t even have been taken up. And since we’re going to get a ruling pretty quick, I think it’s important for us to go ahead and assume that the Supreme Court is going to do what most legal scholars who’ve looked at this would expect them to do.”

Obama added that Congress could also resolve any problems raised by a court ruling “with a one-sentence provision.”

Related: Double Digit Rate Hikes Loom for Obamacare 2016

That kind of response is unlikely to satisfy House Republicans, who are likely to again question Burwell’s previous claims that the administration does not have a “Plan B” in place if the court strikes down federal subsidies for millions of Americans.

Last week, during a Wall Street Journal breakfast, Burwell explained that the administration’s authority is limited. She added that her agency would work with states that are considering creating their own exchanges or using workarounds to avoid losing out on the federal subsidies.

“As always, we will stand ready to work with states, but in terms of administrative authority, we can’t do much,” Burwell said.

Republicans, who have long sought to repeal Obamacare, have criticized the administration for not having a contingency plan in place if the subsidies get struck down.

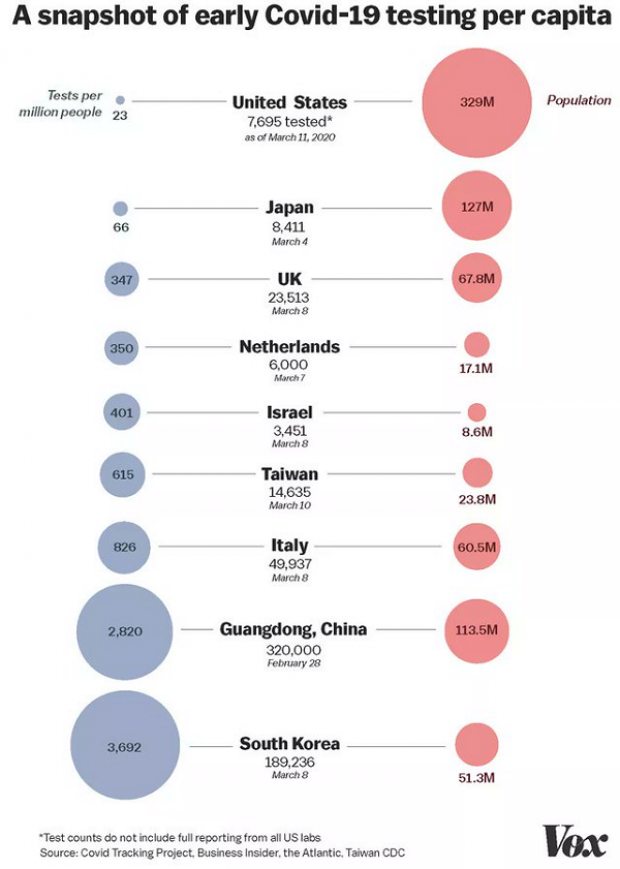

Chart of the Day: Long Way to Go on Coronavirus Testing

The White House on Friday unveiled plans for a new effort to ramp up testing for Covid-19, which experts say is an essential part of limiting the spread of the virus. This chart from Vox gives a sense of just how far the U.S. has to go to catch up to other countries that are dealing with the pandemic, including South Korea, the leading virus screener with 3,692 tests per million people. The U.S., by comparison, has done about 23 tests per million people as of March 12.

After Spending $2 Billion, Air Force Bails Out on Planned Upgrades of B-2 Bombers

The Air Force has scrapped a planned upgrade of its B-2 stealth bomber fleet — even after spending $2 billion on the effort — because defense contractor Northrup Grumman didn’t have the necessary software expertise to complete the project on time and on budget, Bloomberg’s Anthony Capaccio reports, citing the Pentagon’s chief weapons buyer.

Ellen Lord, the undersecretary of defense for acquisition and sustainment, told reporters that the nearly $2 billion that had already been spent on the program wasn’t wasted because “we are still going to get upgraded electronic displays.”

Big Hurdle for Sanders’ Plan to Cancel Student Debt

Bernie Sanders wants to eliminate $1.6 trillion in student debt, to be paid for by a tax on financial transactions, but doing so won’t be easy, says Josh Mitchell of The Wall Street Journal.

The main problem for Sanders is that most Americans don’t support the plan, with 57% of respondents in a poll last fall saying they oppose the idea of canceling all student debt. And the politics are particularly thorny for Sanders as he prepares for a likely general election run, Mitchell says: “Among the strongest opponents are groups Democrats hope to peel away from President Trump: Rust Belt voters, independents, whites, men and voters in rural areas.”

Number of the Day: $7 Million

That’s how much Michael Bloomberg is spending per day in his pursuit of the Democratic presidential nomination, according to new monthly filings with the Federal Election Commission. “In January alone, Bloomberg dropped more than $220 million on his free-spending presidential campaign,” The Hill says. “That breaks down to about $7.1 million a day, $300,000 an hour or $5,000 per minute.”