VA Cited for Neglecting Follow-Up Treatment for Depressed Vets

The embattled Veterans Affairs Department is once again under scrutiny for potentially violating agency guidelines when treating patients—this time, failing to ensure that veterans with depression are receiving sufficient follow-up care after being prescribed anti-depressant medication.

That’s the conclusion of an investigation by the Government Accountability Office. The GAO reviewed patients being treated for depression at six separate VA medical centers and found that after the veterans received anti-depressants, their doctors did not conduct follow-up appointments within four to six weeks, as the VA requires

Related: VA Wastes Millions, But Still Wants More as Vets Wait for Care

In its review, the GAO said that among all patients whose records were reviewed—almost none of them received check ups with doctors in the required time after they were given anti-depressant medication.

"Given the debilitating effect that depression can have on veterans' quality of life, VA's monitoring of veterans with [depression] is critical to ensuring they receive care that is associated with positive health care outcomes," GAO director of health care Randall Williamson said in congressional testimony this week. He went on to criticize the VA for not following its own guidelines to assure veterans receive sufficient treatment.

“This work illustrates, once again, a continuing pattern of VHA's [Veterans Health Administration] noncompliance with its own policies and established procedures,” Randall Williamson, the GAO's director of health care said in congressional testimony last week.

Separately, the GAP flagged the VA’s Behavioral Health Autopsy Program which is used to collect data on veterans that have committed suicide in order to inform policy decisions, saying it is plagued with inaccuracies.

Auditors said that the system had incorrect dates of death—sometimes off by one day, sometimes off by a whole year. The GAO said this made it nearly impossible to assess what kind of treatment they were provided.

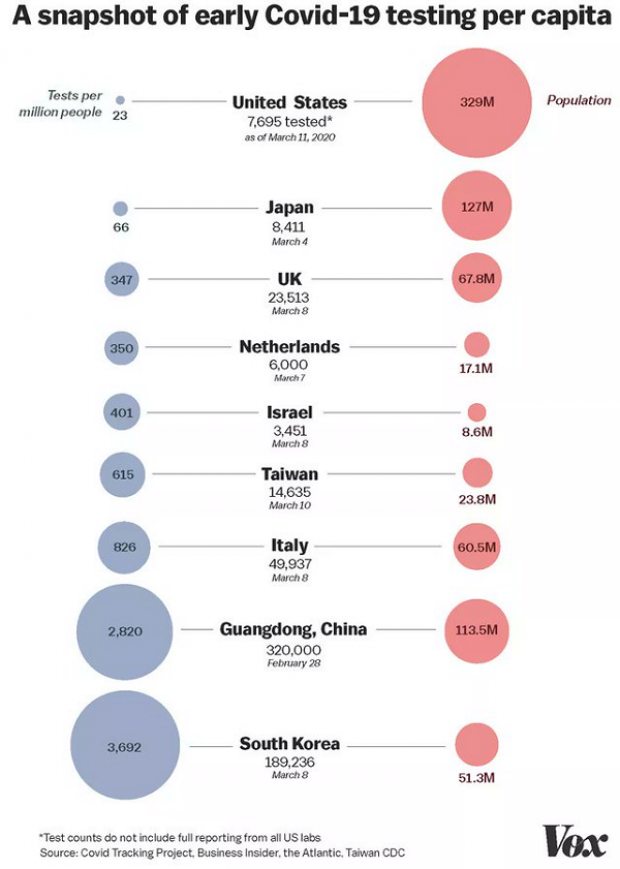

Chart of the Day: Long Way to Go on Coronavirus Testing

The White House on Friday unveiled plans for a new effort to ramp up testing for Covid-19, which experts say is an essential part of limiting the spread of the virus. This chart from Vox gives a sense of just how far the U.S. has to go to catch up to other countries that are dealing with the pandemic, including South Korea, the leading virus screener with 3,692 tests per million people. The U.S., by comparison, has done about 23 tests per million people as of March 12.

After Spending $2 Billion, Air Force Bails Out on Planned Upgrades of B-2 Bombers

The Air Force has scrapped a planned upgrade of its B-2 stealth bomber fleet — even after spending $2 billion on the effort — because defense contractor Northrup Grumman didn’t have the necessary software expertise to complete the project on time and on budget, Bloomberg’s Anthony Capaccio reports, citing the Pentagon’s chief weapons buyer.

Ellen Lord, the undersecretary of defense for acquisition and sustainment, told reporters that the nearly $2 billion that had already been spent on the program wasn’t wasted because “we are still going to get upgraded electronic displays.”

Big Hurdle for Sanders’ Plan to Cancel Student Debt

Bernie Sanders wants to eliminate $1.6 trillion in student debt, to be paid for by a tax on financial transactions, but doing so won’t be easy, says Josh Mitchell of The Wall Street Journal.

The main problem for Sanders is that most Americans don’t support the plan, with 57% of respondents in a poll last fall saying they oppose the idea of canceling all student debt. And the politics are particularly thorny for Sanders as he prepares for a likely general election run, Mitchell says: “Among the strongest opponents are groups Democrats hope to peel away from President Trump: Rust Belt voters, independents, whites, men and voters in rural areas.”

Number of the Day: $7 Million

That’s how much Michael Bloomberg is spending per day in his pursuit of the Democratic presidential nomination, according to new monthly filings with the Federal Election Commission. “In January alone, Bloomberg dropped more than $220 million on his free-spending presidential campaign,” The Hill says. “That breaks down to about $7.1 million a day, $300,000 an hour or $5,000 per minute.”