Millions of Samsung Galaxy Phones May Be Vulnerable to Hackers

If you’re one of the millions of users of a Samsung Galaxy phone, you might be a potential target for a malicious hacker.

A report released today by NowSecure, a security firm located in Chicago, found that a glitch in Swift, the keyboard software used by default on all Samsung Galaxy devices could allow a remote attacker to compromise your phone.

This particular bug makes the phone vulnerable to what is known as a “man in the middle” attack. The Swift software consistently sends requests to a server, checking for updates. To someone with the right knowhow, though, it’s possible to impersonate Swift’s server and send through software that can be used to gain control of the device.

The main problem with this vulnerability is that there’s no real solution. The Swift keyboard is so integrated into Samsung’s software that it cannot be removed or disabled — even if it is switched out with a different keyboard app. Steering clear of unsecured Wi-Fi networks will make you less likely to be targeted, but it won’t render you invulnerable.

Related: 10 Biggest Tech Flops of the Century

Swift runs with elevated permissions, giving it pretty much free rein around the phone. This means that a hacker that worms his way into it can also access the Galaxy’s microphone and camera, track the user’s location or listen to their calls. They can even install apps.

NowSecure claims to have made Samsung and Google’s Android team aware of this vulnerability in late 2014, and Samsung reportedly has made a patch available to network providers. It’s not clear, though, whether providers have pushed out the patch to users yet. Many networks have a record of being notoriously slow to push through updates and security patches, and NowSecure’s tests found a number of Galaxy phones on different carriers were still vulnerable as of Tuesday.

If you’re of a more technical bent, you may be interested in seeing the details of NowSecure’s report on their blog. If you’re of a less technical bent, you might want to check with your carrier and try to avoid insecure Wi-Fi networks.

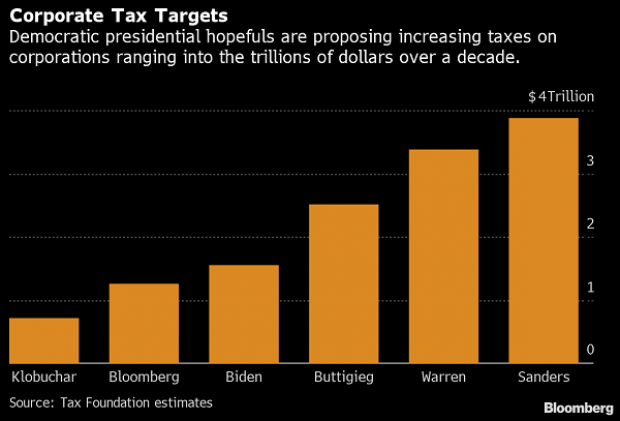

Chart of the Day: Boosting Corporate Tax Revenues

The leading candidates for the Democratic presidential nomination have all proposed increasing taxes on corporations, including raising income tax rates to levels ranging from 25% to 35%, up from the current 21% imposed by the Republican tax cuts in 2017. With Bernie Sanders leading the way at $3.9 trillion, here’s how much revenue the higher proposed corporate taxes, along with additional proposed surtaxes and reduced tax breaks, would generate over a decade, according to calculations by the right-leaning Tax Foundation, highlighted Wednesday by Bloomberg News.

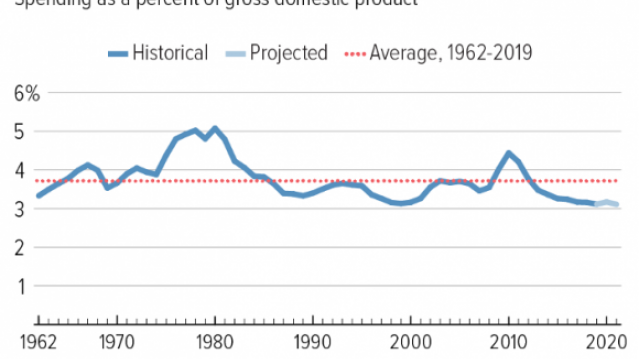

Chart of the Day: Discretionary Spending Droops

The federal government’s total non-defense discretionary spending – which covers everything from education and national parks to veterans’ medical care and low-income housing assistance – equals 3.2% of GDP in 2020, near historic lows going back to 1962, according to an analysis this week from the Center on Budget and Policy Priorities.

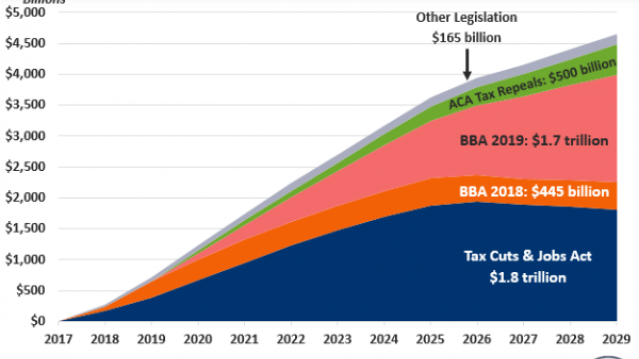

Chart of the Week: Trump Adds $4.7 Trillion in Debt

The Committee for a Responsible Federal Budget estimated this week that President Trump has now signed legislation that will add a total of $4.7 trillion to the national debt between 2017 and 2029. Tax cuts and spending increases account for similar portions of the projected increase, though if the individual tax cuts in the 2017 Republican overhaul are extended beyond their current expiration date at the end of 2025, they would add another $1 trillion in debt through 2029.

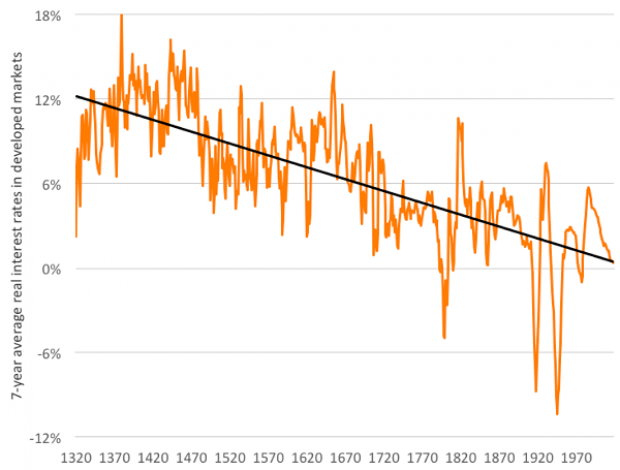

Chart of the Day: The Long Decline in Interest Rates

Are interest rates destined to move higher, increasing the cost of private and public debt? While many experts believe that higher rates are all but inevitable, historian Paul Schmelzing argues that today’s low-interest environment is consistent with a long-term trend stretching back 600 years.

The chart “shows a clear historical downtrend, with rates falling about 1% every 60 years to near zero today,” says Bloomberg’s Aaron Brown. “Rates do tend to revert to a mean, but that mean seems to be declining.”

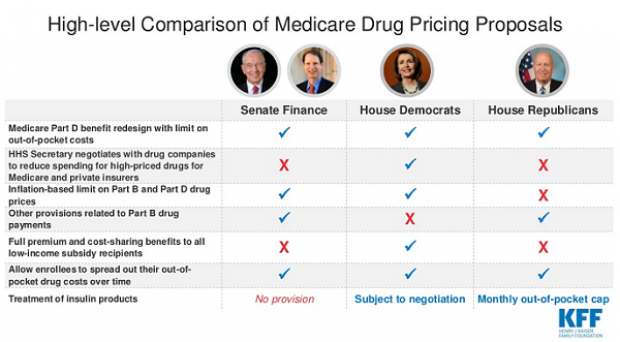

Chart of the Day: Drug Price Plans Compared

Lawmakers are considering three separate bills that are intended to reduce the cost of prescription drugs. Here’s an overview of the proposals, from a series of charts produced by the Kaiser Family Foundation this week. An interesting detail highlighted in another chart: 88% of voters – including 92% of Democrats and 85% of Republicans – want to give the government the power to negotiate prices with drug companies.