Science Confirms: Watching Online Cat Videos Is Good for You

Looking at Grumpy Cat’s underbite and feline dwarfism just might just make you feel better about your bratty kid, your nagging spouse or your demanding boss. That’s right, according to a new study published in the journal Computers in Human Behavior, watching cat videos online reduces our negative feelings while raising our sense of well-being and boosting our energy levels.

Grumpy Cat, whose real pet name is Tardar Sauce, shares a manager with fellow YouTube stars Keyboard Cat and Nyan Cat. Last we checked, the famous feline had 7.7 million Likes on Facebook. In all, more than 2 million cat videos were posted on YouTube last year, gathering nearly 26 billion views. Cat videos had more views per video than any other category of YouTube content. That makes kittens more valuable eye candy than, say, Maxim’s Hot 100. (Taylor Swift topped the list this year, just in case you were wondering.)

Related: The Internet Power of Kim Kardashian’s Butt

For the new study, Jessica Gall Myrick, an assistant professor at the Indiana University Media School, surveyed nearly 7,000 Internet users about how watching cat videos affects their moods. She got a little help from Bloomington, Indiana resident Mike Bridavsky — the owner of Internet celebrity cat Lil Bub — who used social media to recruit participants for the survey.

The results should make you feel a bit less guilty about clicking through one cat video after another: “Even if they are watching cat videos on YouTube to procrastinate or while they should be working, the emotional pay-off may actually help people take on tough tasks afterward,” Myrick says.

Don’t think watching cat videos online is a pop culture phenomenon worthy of academic research? Myrick disagrees: “If we want to better understand the effects the Internet may have on us as individuals and on society, then researchers can’t ignore Internet cat videos anymore.”

Read the original paper on emotion regulation procrastination, and watching cat videos online here.

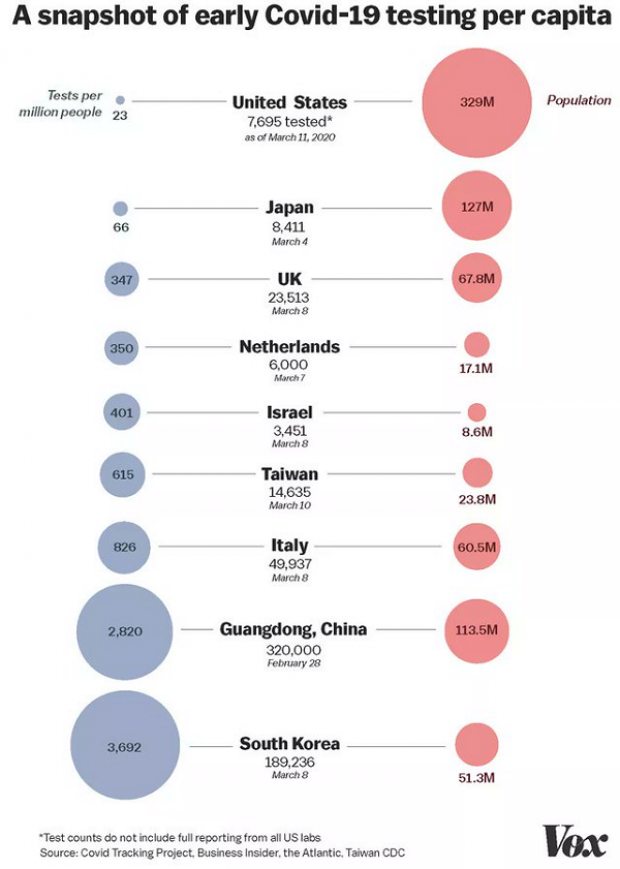

Chart of the Day: Long Way to Go on Coronavirus Testing

The White House on Friday unveiled plans for a new effort to ramp up testing for Covid-19, which experts say is an essential part of limiting the spread of the virus. This chart from Vox gives a sense of just how far the U.S. has to go to catch up to other countries that are dealing with the pandemic, including South Korea, the leading virus screener with 3,692 tests per million people. The U.S., by comparison, has done about 23 tests per million people as of March 12.

After Spending $2 Billion, Air Force Bails Out on Planned Upgrades of B-2 Bombers

The Air Force has scrapped a planned upgrade of its B-2 stealth bomber fleet — even after spending $2 billion on the effort — because defense contractor Northrup Grumman didn’t have the necessary software expertise to complete the project on time and on budget, Bloomberg’s Anthony Capaccio reports, citing the Pentagon’s chief weapons buyer.

Ellen Lord, the undersecretary of defense for acquisition and sustainment, told reporters that the nearly $2 billion that had already been spent on the program wasn’t wasted because “we are still going to get upgraded electronic displays.”

Big Hurdle for Sanders’ Plan to Cancel Student Debt

Bernie Sanders wants to eliminate $1.6 trillion in student debt, to be paid for by a tax on financial transactions, but doing so won’t be easy, says Josh Mitchell of The Wall Street Journal.

The main problem for Sanders is that most Americans don’t support the plan, with 57% of respondents in a poll last fall saying they oppose the idea of canceling all student debt. And the politics are particularly thorny for Sanders as he prepares for a likely general election run, Mitchell says: “Among the strongest opponents are groups Democrats hope to peel away from President Trump: Rust Belt voters, independents, whites, men and voters in rural areas.”

Number of the Day: $7 Million

That’s how much Michael Bloomberg is spending per day in his pursuit of the Democratic presidential nomination, according to new monthly filings with the Federal Election Commission. “In January alone, Bloomberg dropped more than $220 million on his free-spending presidential campaign,” The Hill says. “That breaks down to about $7.1 million a day, $300,000 an hour or $5,000 per minute.”