It’s Not Just in Your Head, the Web Is Slowing Down

It’s not your imagination, and it’s not because AT&T — and possibly others — is purposefully cutting speeds to unlimited data plan users. The Internet is slowing down. The reason: Websites are growing in size, causing slower load times.

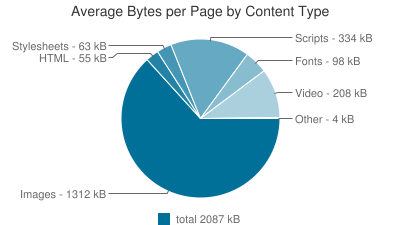

The average website is now 2.1 MB in size, compared to 1.5 MB two years ago, according to HTTP Archive, an Internet data measurement company. Multiple reasons can explain this increase in size.

Sites have been adding more content in an effort to drum up traffic, such as videos, engaging images, interactive plug-ins (comments and feeds) and other code and script-heavy features. Websites are becoming more and more technically advanced, and other sites have to keep adding features to stay competitive.

To keep up with the rapidly increasing number of users accessing sites on various platforms, developers are offering more versions of websites as well as apps to accommodate all devices, including smartphones, watches, tablets, and other gadgets. All of these versions require additional code, ultimately adding to the weight of a given website.

Then there are the advertisers who want to get the user’s attention by creating dramatic displays for their products that consume even more bandwidth.

Websites also want to know who is visiting their pages, both welcome and unwelcome visitors. New tools that track and analyze visitors have increased in popularity, as well as stronger encryption technology to add more security. These security measures and trackers require more code, again slowing load times.

Unfortunately for websites trying to keep up with the times, Google has just introduced a new ‘Slow to Load’ warning sign in mobile search results. Since mobile searches account for more than half of the total Google searches in 10 countries, Google wants to enhance user experience for those on their mobile platform.

Although the weight of a website isn’t all that contributes to slow loading, it’s a major factor. Other reasons include users overusing data, a poor connection, or a high level of traffic in the mobile network.

Google also changed its algorithm in April, so now ‘mobile friendly’ sites are ranked higher on search results, while those that fail to meet its criteria are ranked lower.

Although the internet is only slowing by a matter of seconds, it’s still slowing down. All the more reason for a user to become frustrated with a page that’s taking a couple extra seconds to load and go to a competitor’s site.

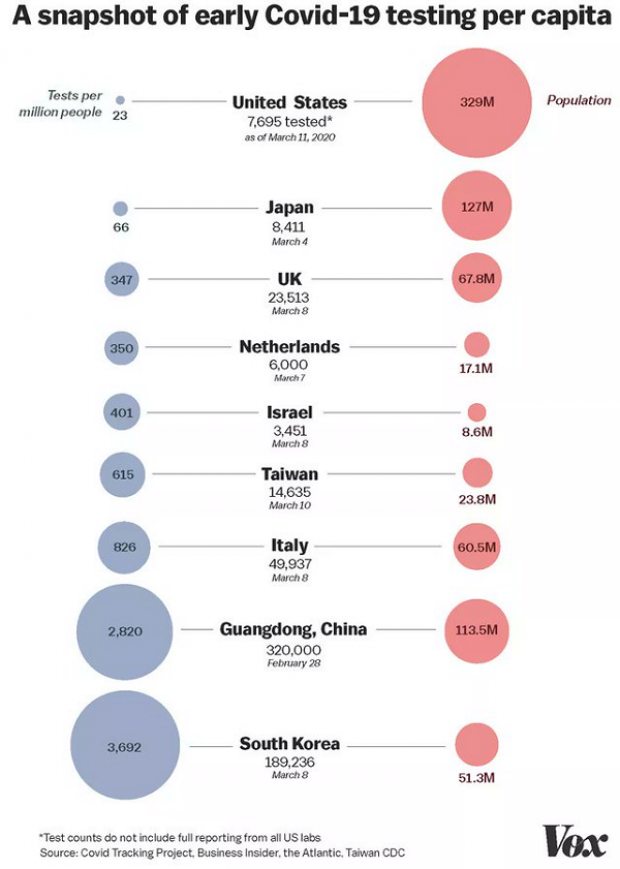

Chart of the Day: Long Way to Go on Coronavirus Testing

The White House on Friday unveiled plans for a new effort to ramp up testing for Covid-19, which experts say is an essential part of limiting the spread of the virus. This chart from Vox gives a sense of just how far the U.S. has to go to catch up to other countries that are dealing with the pandemic, including South Korea, the leading virus screener with 3,692 tests per million people. The U.S., by comparison, has done about 23 tests per million people as of March 12.

After Spending $2 Billion, Air Force Bails Out on Planned Upgrades of B-2 Bombers

The Air Force has scrapped a planned upgrade of its B-2 stealth bomber fleet — even after spending $2 billion on the effort — because defense contractor Northrup Grumman didn’t have the necessary software expertise to complete the project on time and on budget, Bloomberg’s Anthony Capaccio reports, citing the Pentagon’s chief weapons buyer.

Ellen Lord, the undersecretary of defense for acquisition and sustainment, told reporters that the nearly $2 billion that had already been spent on the program wasn’t wasted because “we are still going to get upgraded electronic displays.”

Big Hurdle for Sanders’ Plan to Cancel Student Debt

Bernie Sanders wants to eliminate $1.6 trillion in student debt, to be paid for by a tax on financial transactions, but doing so won’t be easy, says Josh Mitchell of The Wall Street Journal.

The main problem for Sanders is that most Americans don’t support the plan, with 57% of respondents in a poll last fall saying they oppose the idea of canceling all student debt. And the politics are particularly thorny for Sanders as he prepares for a likely general election run, Mitchell says: “Among the strongest opponents are groups Democrats hope to peel away from President Trump: Rust Belt voters, independents, whites, men and voters in rural areas.”

Number of the Day: $7 Million

That’s how much Michael Bloomberg is spending per day in his pursuit of the Democratic presidential nomination, according to new monthly filings with the Federal Election Commission. “In January alone, Bloomberg dropped more than $220 million on his free-spending presidential campaign,” The Hill says. “That breaks down to about $7.1 million a day, $300,000 an hour or $5,000 per minute.”