When Jeff Bezos founded Amazon 21 years ago, he made it clear he was shooting for the moon. That moon was Walmart, and Amazon, the nascent startup, planned to be the largest online retailer in the world.

Bezos reached his goal as the largest Internet-based retailer in the U.S.; but now, he faces a huge challenge if he wants to stay there. Walmart has decided to kick Amazon off its cyber perch by going straight for the heart of Bezos’s marketing plan—Amazon Prime.

Related: Amazon, Google Join Retailers in Banning Confederate Flag

Walmart can match Amazon in terms of warehouse delivery, can match or beat Amazon on most prices, and will charge half the fee that Amazon customers now pay for Prime service--$50 a year.

That’s why Bezos has announced a massive online shopping event on July 15 exclusively for its Prime members, which the company claims will rival Black Friday. Members can shop thousands of deals on Prime Day and will be given unlimited free two-day shipping, giving the subscription service tons of exposure.

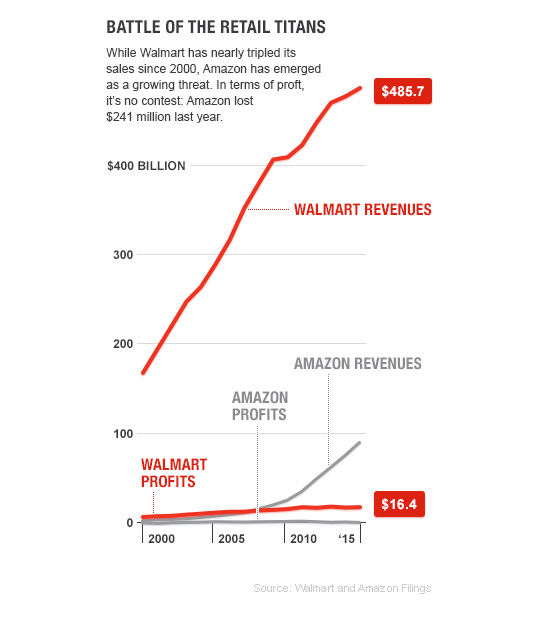

Source: Fortune

Aggressively advertising the event, Amazon hopes the publicity will attract more subscribers to Amazon Prime. Walmart launched the initial phase of its subscription program, Shipping Pass, in June but has yet to fully implement it.

A Prosper Insights survey asked 6,000 people how they felt about Shipping Pass and their likelihood of purchasing a membership. The study found that only 12.4 percent of respondents were “likely” or “very likely” to sign up for Shipping Pass. That percentage equates to about 18 million households. Amazon Prime is estimated to have around 40 million subscribers.

Related: Amazon to Pay Self-Published Authors Based on Pages Read

While the percentage may seem discouraging for Walmart, there was some hopeful news. About half of the respondents who answered “likely” or “very likely” were identified as millennials, a major target group for e-commerce companies because of the size of their generation – roughly 78 million – and their potential for becoming big-spenders. In addition, the average potential subscriber earned almost $63,000 per year, about 5 percent more than typical Walmart shoppers did.

Even though membership costs more, Amazon, has an edge in addition to being a first mover in this space because it also offers video streaming and unlimited cloud photo storage. Prime members also receive early-access deals from Amazon’s MyHabit.com, a shopping website, and same-day delivery in some markets. Subscribers to Prime also receive free two-day shipping, while Shipping Pass only offers free three-day shipping.

While unclear if Shipping Pass will help Walmart’s bottom line, the company has taken other major steps to catch up to Amazon and it’s paying off – they are currently the number two e-commerce retailer in the U.S. and still expanding. In the past four years, the online sector of the company, based in San Bruno, CA, has grown from 500 to 2,500 employees. One reason--the company recognized the growth in smartphone use and has simplified the online checkout process for consumers using mobile devices.

According to Scott Strawn, an analyst at global marketing firm IDC, Walmart wants to keep pace with the universal shift to online shopping and is trying to replicate Amazon’s model because it might be the only way to remain competitive in coming years. “In some ways, it’s something Walmart has to do,” Strawn says.

Related: Amazon Insists Federal Rules Apply to Deliveries by Drone

In the past few years, Walmart has adapted more than 80 of its U.S. super centers to assist with filling online orders and to speed up its delivery service. Amazon has no physical stores. Having existing locations is a valuable advantage for Walmart since customers can return an item they’ve purchased online themselves, rather than deal with the hassle of sending it back. “Having that capability is something that might be a bit of an advantage,” Strawn says.

Rumors were floating around that Amazon wanted to purchase Radio Shack in February in order to have physical store locations as well. Not only would the stores be used for pickups and deliveries, but also for returns. However, no further information has been provided.

Additionally, Walmart shoppers can pick up online non-grocery orders at any of the 4,500 U.S. stores that the company operates. Four new automated distribution centers have also been opened exclusively for online orders, each 1.2 million square feet.

Even with all of these initiatives, Walmart’s e-commerce grew 17 percent in the first quarter of 2015 from a year earlier, a slower rate than in recent quarters and below Target’s growth rates. Between 2013 and 2014, Walmart grew 22 percent in e-commerce sales to $12.2 billion. However, that’s merely a small fraction of the $288 billion the company generated in U.S. sales, and only around one-sixth of Amazon’s sales.

“It’s going to be really tough for Walmart to catch up, but that doesn’t mean that they can’t,” Strawn says.

Top Reads from The Fiscal Times: