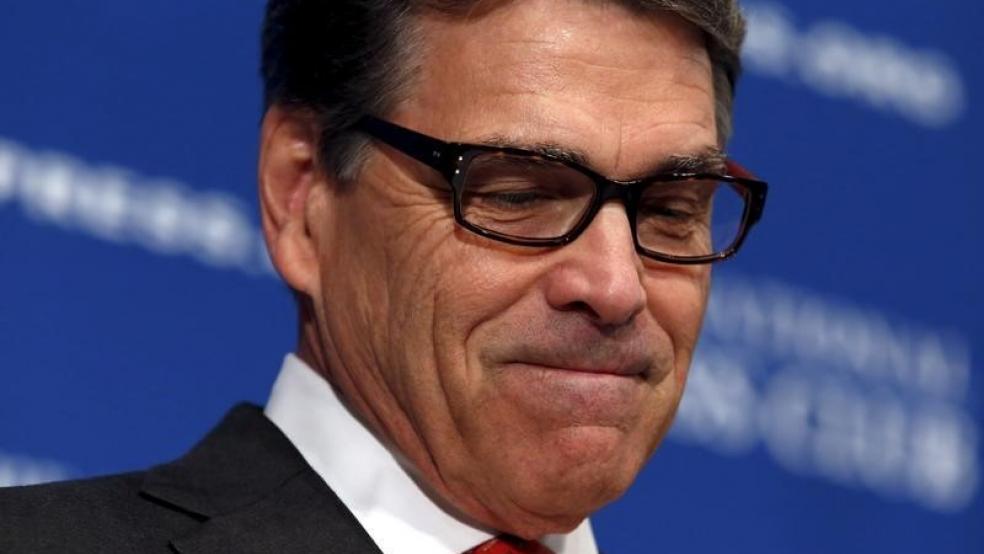

In his speech on Wednesday to a conservative financial group in New York, former Texas governor Rick Perry probably didn’t raise many eyebrows when he launched an assault on the Consumer Financial Protection Bureau, the brainchild of Sen. Elizabeth Warren (D-MA).

Republicans have complained for years that the CFPB has too much power and too little congressional oversight since it was created as part of the Dodd-Frank financial overhaul in 2010.

Related: Economy Is Voters’ Top Worry: A Break for Rick Perry?

What likely did surprise the audience, according to an account yesterday by Peter Schroeder of The Hill, was the Republican presidential candidate’s call for new financial policies that would break up big banks and end the notion that some banks are simply too big to fail.

The “too big to fail” theory that prevailed throughout the 2007-2010 global financial crisis holds that certain financial institutions -- including JP Morgan Chase, Bank of America and Citigroup -- are so vast and interconnected that their failure would bring down the economy.

The question of whether something should be done to break up the big banks has long been a quandary for both parties, although it is a popular battle cry for many liberal Democrats, including Warren and Sen. Bernie Sanders of Vermont.

Perry, who is trying revive his presidential hopes after a disastrous 2012 campaign and a weak showing thus far for 2016, apparently took a stand far to the left of Democratic frontrunner Hillary Clinton -- and squarely in the camp of Warren and Sanders -- by advocating for new policies to break up big banks.

Related: Rick Perry tells Republicans to work harder for black votes

In a meaty, substantive speech, the former governor outlined his ideas for reforming Wall Street, including what sounded like a return to the 1933 Glass-Steagall Act that for decades provided a firewall between traditional commercial banking and far riskier investment banking. Congress and the Clinton administration enacted legislation in 1999 that repealed two provisions of the law which restricted affiliation between banks and security firms.

Perry echoed the view that the elimination of the firewall between banking and investing turned out to be a prelude to reckless banking practices. Banking critics have long contended that – once the wall came down – banks originated fraudulent loans and sold them to their customers in the form of securities. The bubble peaked in 2007 and then the market collapsed.

According to The Hill, Perry did not specifically utter the words “restore Glass-Steagall,” but he floated a number of proposals that sounded an awful lot like restoring the law. “We could once again require banks to separate their traditional commercial lending and investment banking and related practices,” he said, according to his prepared remarks.

Related: Bernie Won’t Be President, but He’s Still Bad News for the GOP

Perry also discussed other ideas for requiring large banks to hold additional capital as a cushion against emergencies and shortfalls, but the reference to issues historically related to Glass-Steagall is the one that generated the buzz.

As The Washington Post noted today, some GOP lawmakers have signed on to the idea of a Glass-Steagall revival, but Perry is the first to address the topic directly.

Hillary Clinton has declined so far to take a clear position on Glass-Steagall and was heckled about it during a major economic speech she delivered earlier this month in New York. Two of her Democratic primary rivals, Sanders and former Maryland Gov. Martin O'Malley of Maryland, have said they support restoring the law.