CVS Quit Selling Cigarettes, but It’s Found a Patch for Sales

CVS executives knew that some of their sales would go up in smoke when they decided last year to stop selling cigarettes. The press release announcing that all 7,600 CVS stores nationwide would stop selling all tobacco products acknowledged that sales would take a hit. Still, the company said, “This is the right thing to do.”

The costs of the decision are now becoming clear. CVS Health’s general merchandise sales slumped 7.8 percent last quarter on a same-store basis, the company said Tuesday. The company claims non-pharmacy sales would have stayed the same if tobacco sales — and the other products cigarette buyers added to their baskets — were removed from sales figures for the same quarter in 2014.

Related: Why Smoking Is Even Worse Than We Thought

Same-store sales in the pharmacy category climbed 4.1 percent, boosting overall same-store sales growth to 0.5 percent compared with the second quarter of last year, down from a 1.2 percent year-over-year increase the previous quarter. Net revenue overall grew by 7.4 percent to $37.2 billion, helped by pharmacy services revenue that surged 11.9 percent ($2.6 billion) to $24.4 billion. The company has reportedly increased its market share in the health and beauty categories (it did, however, narrow its full-year earnings forecast).

So even as the move to drop cigarettes has cost the company, its bet on health as the source of future growth may be starting to pay off. CVS stock dropped in the wake of its earnings announcement, but shares are still up more than 15 percent on the year and 44 percent over the past 12 months.

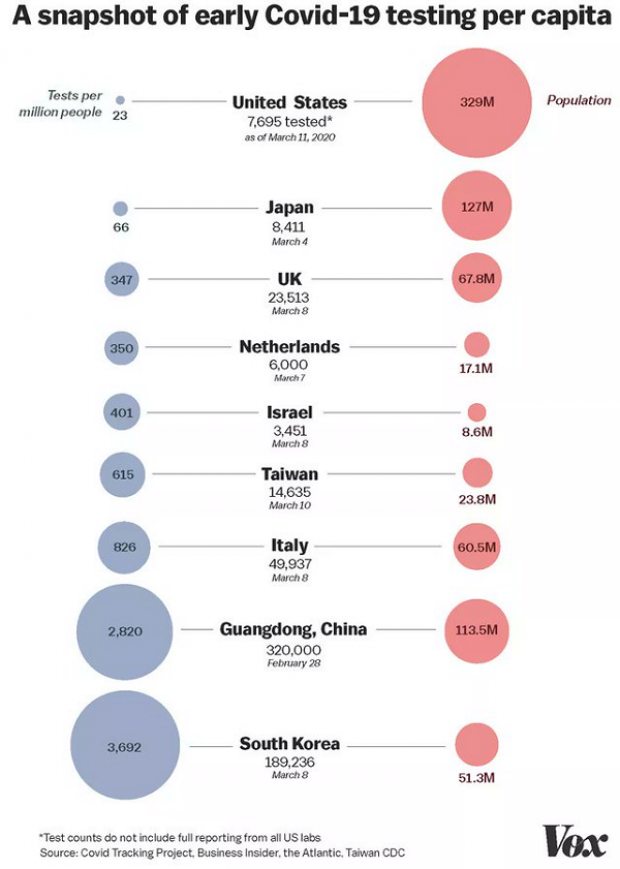

Chart of the Day: Long Way to Go on Coronavirus Testing

The White House on Friday unveiled plans for a new effort to ramp up testing for Covid-19, which experts say is an essential part of limiting the spread of the virus. This chart from Vox gives a sense of just how far the U.S. has to go to catch up to other countries that are dealing with the pandemic, including South Korea, the leading virus screener with 3,692 tests per million people. The U.S., by comparison, has done about 23 tests per million people as of March 12.

After Spending $2 Billion, Air Force Bails Out on Planned Upgrades of B-2 Bombers

The Air Force has scrapped a planned upgrade of its B-2 stealth bomber fleet — even after spending $2 billion on the effort — because defense contractor Northrup Grumman didn’t have the necessary software expertise to complete the project on time and on budget, Bloomberg’s Anthony Capaccio reports, citing the Pentagon’s chief weapons buyer.

Ellen Lord, the undersecretary of defense for acquisition and sustainment, told reporters that the nearly $2 billion that had already been spent on the program wasn’t wasted because “we are still going to get upgraded electronic displays.”

Big Hurdle for Sanders’ Plan to Cancel Student Debt

Bernie Sanders wants to eliminate $1.6 trillion in student debt, to be paid for by a tax on financial transactions, but doing so won’t be easy, says Josh Mitchell of The Wall Street Journal.

The main problem for Sanders is that most Americans don’t support the plan, with 57% of respondents in a poll last fall saying they oppose the idea of canceling all student debt. And the politics are particularly thorny for Sanders as he prepares for a likely general election run, Mitchell says: “Among the strongest opponents are groups Democrats hope to peel away from President Trump: Rust Belt voters, independents, whites, men and voters in rural areas.”

Number of the Day: $7 Million

That’s how much Michael Bloomberg is spending per day in his pursuit of the Democratic presidential nomination, according to new monthly filings with the Federal Election Commission. “In January alone, Bloomberg dropped more than $220 million on his free-spending presidential campaign,” The Hill says. “That breaks down to about $7.1 million a day, $300,000 an hour or $5,000 per minute.”