Residents of the Garden State are paying a whole lot for their gardens, according to a new analysis of property tax rates by the Tax Foundation.

Property taxes in the U.S. are a complicated patchwork of different policies set by states, cities and counties as well as local school boards, fire departments and utility commissions. Those differences — and the added complexity of valuing property — can make it difficult to arrive at apples-to-apples comparisons of property tax rates.

Related: The 10 Worst States for Taxes in 2015

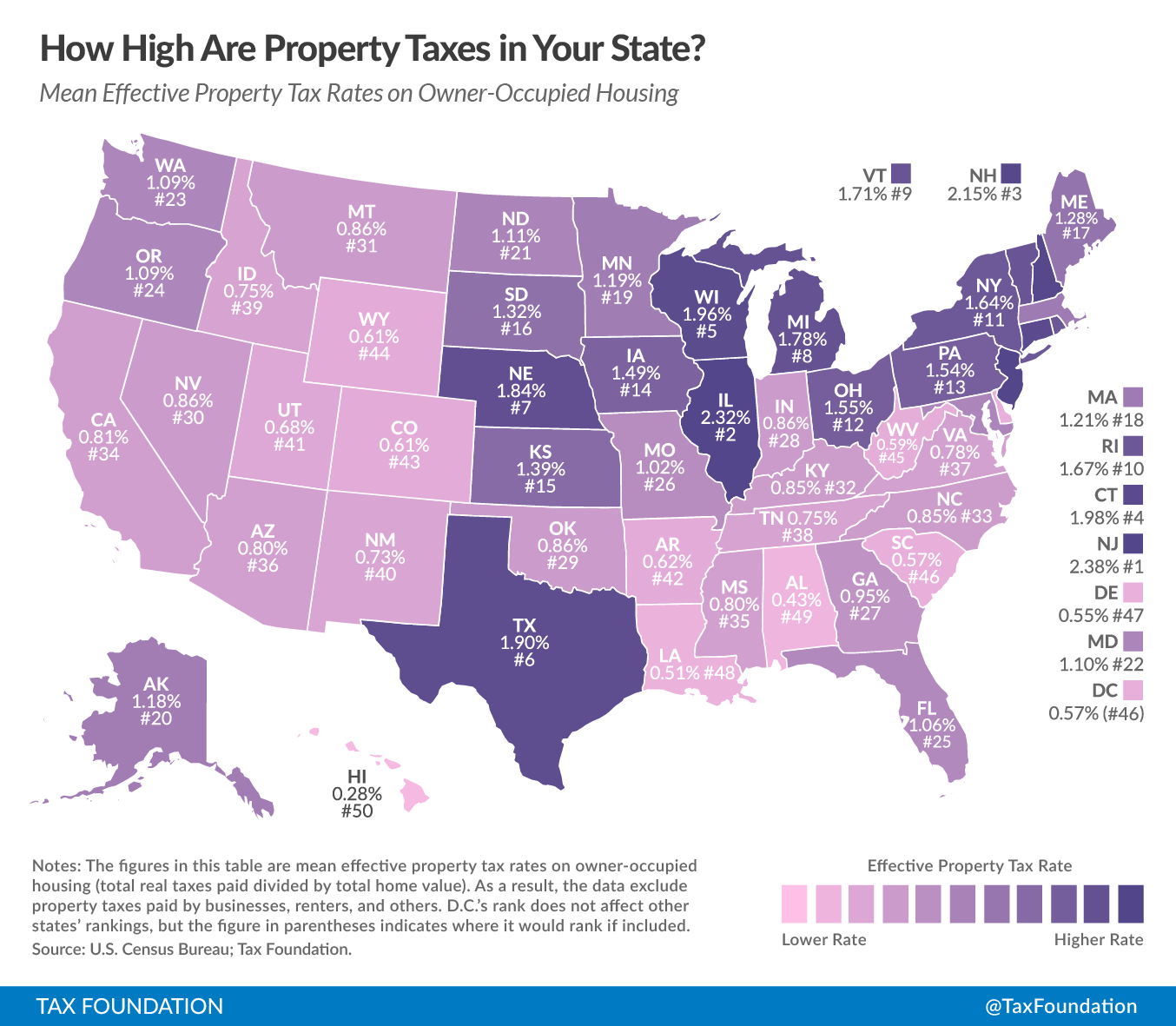

To cut through all those variables and map out where property tax rates are highest, the Tax Foundation looked at effective tax rates on owner-occupied housing. “This is the average amount of residential property tax actually paid, expressed as a percentage of home value,” the foundation’s Jared Walczak wrote in a blog post Thursday. The calculations exclude property taxes paid by businesses, renters and others. You can see how your state stacks up on the map below.

Keep in mind also that property taxes are just one part of your total tax bill. “Some states with high property taxes, like New Hampshire and Texas, rely heavily on property taxes in lieu of other major tax categories; others, like New Jersey and Illinois, impose high property taxes alongside high rates in the other major tax categories,” Walczak explains.

More reason for New Jersey residents to grumble.

Here are the 10 states with the highest effective property tax rates for homeowners, with mroe details on each of them below:

| State | Tax Rate |

| New Jersey | 2.38% |

| Illinois | 2.32% |

| New Hampshire | 2.15% |

| Connecticut | 1.98% |

| Wisconsin | 1.96% |

| Texas | 1.90% |

| Nebraska | 1.84% |

| Michigan | 1.78% |

| Vermont | 1.71% |

| Rhode Island | 1.67% |

1. New Jersey: 2.38 percent

Median Property Tax Paid on Homes: $7,331

Median Home Value: $307,700

High property taxes are a perennial complaint from residents of the Garden State, which relies heavily on those revenues to fund local governments and schools, among other services. The average property tax bill climbed to $8,161 last year, according to the state’s Department of Community Affairs. That may help explain why a survey late last year by Monmouth University and the Asbury Park Press found — for the seventh year in a row — that 50 percent of New Jersey residents said they would like to leave the state at some point. More than half of those surveyed cited high costs or taxes, including 24 percent who blamed property taxes, as their main reason for wanting to move.

2. Illinois: 2.32 percent

Median Property Tax Paid on Homes: $3,939

Median Home Value: $169,600

Illinois is home to almost 8,500 different bodies of local government, with more than 6,000 able to raise taxes, Reuters reported recently. As the state grapples with a budget crisis, Gov. Bruce Rauner has proposed a property tax freeze, but has tied it to other reform measures unpopular with state Democratic lawmakers.

3. New Hampshire: 2.15 percent

Median Property Tax Paid on Homes: $5,017

Median Home Value: $233,300

A number of New England states make this list, with New Hampshire ranked highest. The Granite State does not tax earned income, so it relies more on real estate taxes for revenues. Even so, the Tax Foundation says residents face an overall state and local tax burden that is among the lowest in the country.

4. Connecticut: 1.98 percent

Median Property Tax Paid on Homes: $5,280

Median Home Value: $267,000

The state’s median property tax paid on homes is second only to New Jersey’s. Budget legislation passed earlier this year reportedly lowered property tax credits for income tax filers from $300 to $200.

5. Wisconsin: 1.96 percent

Median Property Tax Paid on Homes: $3,202

Median Home Value: $163,000

The good news for Wisconsin homeowners: Under the 2015-2017 state budget, property tax bills on the median-valued house will fall this year and next, according to the state’s nonpartisan Legislative Fiscal Bureau. The bad news: The decrease is projected to be $1 this year and $2 next year.

6. Texas: 1.90 percent

Median Property Tax Paid on Homes: $2,510

Median Home Value: $132,000

With no state income tax, Texas is another state that relies heavily on property taxes for revenue. But rising property values in cities like Austin sparked an outcry earlier this year as a result of the rising property tax bills that have followed. “A key problem, critics say, is that the current system has shifted a disproportionate share of the burden of paying for schools and local services on homeowners, in favor of commercial and corporate interests who can afford to appeal their values and win big reductions year after year,” the Austin American-Statesman reported in May.

7. Nebraska: 1.84 percent

Median Property Tax Paid on Homes: $2,438

Median Home Value: $132,700

The Open Sky Policy Institute, a Nebraska think tank on fiscal matters, says the state ranks second in the nation for reliance on property taxes and other local revenue sources to fund K-12 education. Gov. Pete Ricketts, a Republican, has touted $408 million in property tax relief approved earlier this year as part of the state’s two-year budget, and lawmakers are looking for other ways to lower property taxes.

8. Michigan: 1.78 percent

Median Property Tax Paid on Homes: $2,090

Median Home Value: $117,500

Detroit’s mayor announced early this year that more than half of the city’s residents will see their property tax assessments fall by 10 percent as part of a citywide real estate reappraisal, with some residents getting 20 percent reductions.

9. Vermont: 1.71 percent

Median Property Tax Paid on Homes: $3,727

Median Home Value: $218,300

Vermont residents face a double whammy of relatively high property taxes on top of a state income tax system that the Tax Foundation says ranks 7th highest among states the levy such individual taxes. The state passed legislation earlier this year intended to reform education spending and halt the rapid rise of property taxes.

10. Rhode Island: 1.67 percent

Median Property Tax Paid on Homes: $3, 872

Median Home Value: $232,300

On average, property owners in the state spend more than $49 of every $1,000 in income on property taxes, according to The Providence Journal. Democratic Gov. Gina Riamondo had proposed a so-called “Taylor Swift tax” of $2.50 per $1,000 in assessed value on second homes worth more than $1 million. (The pop singer bought a $17 million mansion in the state a few years back.) Raimondo dropped the plan in May after new projections showed state revenues to be better than had been expected.

This article was updated at 12:30 on Aug. 19, 2015.