Doctors to Trump: Deporting Illegal Immigrants Would Be Bad for U.S. Health

The American College of Physicians has a message for Donald Trump and any other presidential contender advocating for mass deportation of illegal immigrants: Any plan to kick out those 12 million people from the country could have severe public health consequences.

On Tuesday, the doctors’ group, which represents 143,000 internists, released a statement urging physicians to take a stand against proposals for mass deportation.

Related: Vast Majority of Americans Say Illegal Immigrants Should Stay

“Large-scale deportation of undocumented residents would have severe and unacceptable adverse health consequences for many millions of vulnerable people,” Dr. Wayne J. Riley, the groups’ president, said in a statement. “Numerous studies show that deportation itself, as well as the fear of being deported, causes emotional distress, depression, trauma associated with imposed family separations, and distrust of anyone assumed to be associated with federal, state and local government, including physicians and other health care professionals providing care in publicly-funded hospitals and clinics.”

That distrust, in turn, could result in sick people not getting medical attention, and in cases of patients with infectious diseases, it could even lead to a public health emergency with tremendous costs to the to the overall health care system, the group warned.

On the other hand, having illegal immigrants in the country carries health care costs, too. Medicaid pays around $2 billion a year for emergency treatment for illegal immigrants, Kaiser Health News reported in 2013, adding that the total represents less than 1 percent of total Medicaid costs.

Related: Birthright Citizenship, the New Immigration Scam

Still, the American College of Physicians said doctors have an ethical obligation to advocate for the health interests of all people, without consideration of their residency status.

“Physicians and other health professionals must remind politicians and policymakers that deporting millions of vulnerable people would have adverse health care consequences, not only for the people directly affected and their families, but also for their local communities and for the United States as whole,” Riley said in the statement. “Instead, we need a balanced immigration policy that ensures access to healthcare for all U.S. residents while recognizing that we need appropriate controls over who is admitted.”

Top Reads From The Fiscal Times

- The 10 States with the Worst Roads

- 5 Reasons the Trump Immigration Plan Doesn’t Pass the Reality Test

- Scott Walker Adjusts His Immigration Stance. Again.

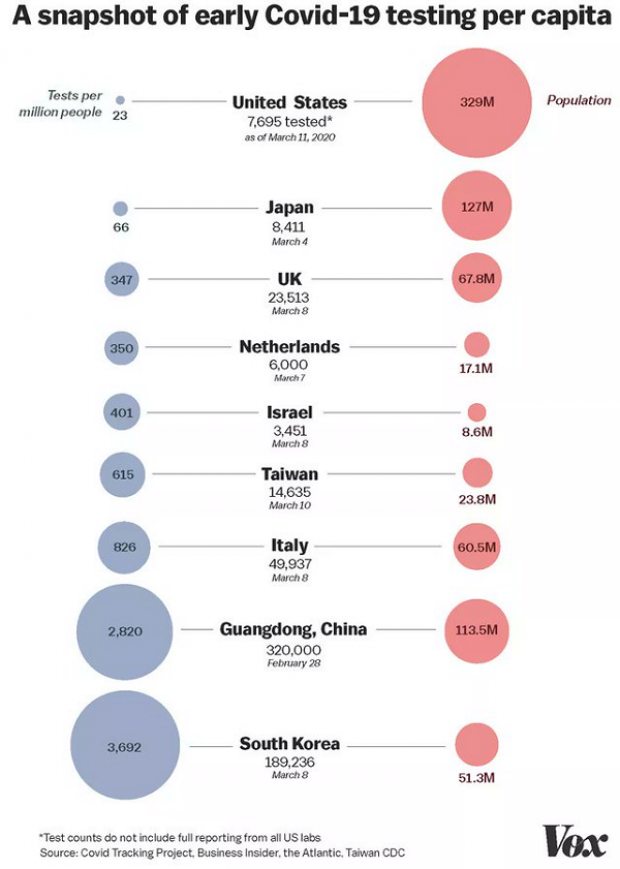

Chart of the Day: Long Way to Go on Coronavirus Testing

The White House on Friday unveiled plans for a new effort to ramp up testing for Covid-19, which experts say is an essential part of limiting the spread of the virus. This chart from Vox gives a sense of just how far the U.S. has to go to catch up to other countries that are dealing with the pandemic, including South Korea, the leading virus screener with 3,692 tests per million people. The U.S., by comparison, has done about 23 tests per million people as of March 12.

After Spending $2 Billion, Air Force Bails Out on Planned Upgrades of B-2 Bombers

The Air Force has scrapped a planned upgrade of its B-2 stealth bomber fleet — even after spending $2 billion on the effort — because defense contractor Northrup Grumman didn’t have the necessary software expertise to complete the project on time and on budget, Bloomberg’s Anthony Capaccio reports, citing the Pentagon’s chief weapons buyer.

Ellen Lord, the undersecretary of defense for acquisition and sustainment, told reporters that the nearly $2 billion that had already been spent on the program wasn’t wasted because “we are still going to get upgraded electronic displays.”

Big Hurdle for Sanders’ Plan to Cancel Student Debt

Bernie Sanders wants to eliminate $1.6 trillion in student debt, to be paid for by a tax on financial transactions, but doing so won’t be easy, says Josh Mitchell of The Wall Street Journal.

The main problem for Sanders is that most Americans don’t support the plan, with 57% of respondents in a poll last fall saying they oppose the idea of canceling all student debt. And the politics are particularly thorny for Sanders as he prepares for a likely general election run, Mitchell says: “Among the strongest opponents are groups Democrats hope to peel away from President Trump: Rust Belt voters, independents, whites, men and voters in rural areas.”

Number of the Day: $7 Million

That’s how much Michael Bloomberg is spending per day in his pursuit of the Democratic presidential nomination, according to new monthly filings with the Federal Election Commission. “In January alone, Bloomberg dropped more than $220 million on his free-spending presidential campaign,” The Hill says. “That breaks down to about $7.1 million a day, $300,000 an hour or $5,000 per minute.”