U.S. manufacturing just had its worst month since the Great Recession. The Institute for Supply Management’s Purchasing Manager’s Index, a monthly gauge of factory activity, fell from 50.1 in October to 48.6 last month. A reading below 50 indicates manufacturing activity is contracting, and this is the first time that’s happened since November 2012. It’s also the weakest reading since June 2009.

The index remains solidly above the level that would indicate another recession, but the disappointing reading — hurt by a strong U.S. dollar, businesses seeking to correct an inventory glut, low oil prices and the consequent pullback in spending by energy companies — is still grim.

Related: Why Most U.S. Manufacturing Jobs Are Gone Forever

“The manufacturing sector remains in a funk,” Michael Montgomery, an economist with IHS Global Insight, wrote in a note to clients. That’s true globally. “The manufacturing sector is suffering from a bad case of the blahs worldwide; some countries are firming from tepid to less tepid and others are in modest retreat, but worldwide PMI scores are hovering around 50 due to anemic global demand for goods,” Montgomery added.

The U.S. manufacturing sector’s problems aren’t new … and they aren’t likely to go away anytime soon. “The November word of the month is ‘forgettable,’ as malaise has lingered in manufacturing for so long that purchasing folks have started to nod off from boredom,” Montgomery wrote. “The bad news is that the tedium will persist well into 2016 (probably until spring), and provide a long hibernation for manufacturing to forget the eminently forgettable close of 2015 and start to 2016.”

But here’s the good news: Manufacturing now represents a relatively small segment of the U.S. economy — just 12 percent, and less than 10 percent of total employment — and the other 88 percent of the economy is doing much better. Witness today’s data showing construction spending near an eight-year high and car sales, forecast to have had the best November on record, still on pace for a record year.

Related: Why Black Friday Is Now a Huge Day for Car Buying

“The services sector is 5.6 times bigger than manufacturing, which is why the industrial downshift is being accompanied by a continued rapid fall in unemployment,” economist Ian Shepherdson of Pantheon Macroeconomics pointed out Tuesday. Plus, as Shepherdson noted, many of the factors dragging down manufacturing activity — cheap oil and gas, the strong dollar — also help consumers.

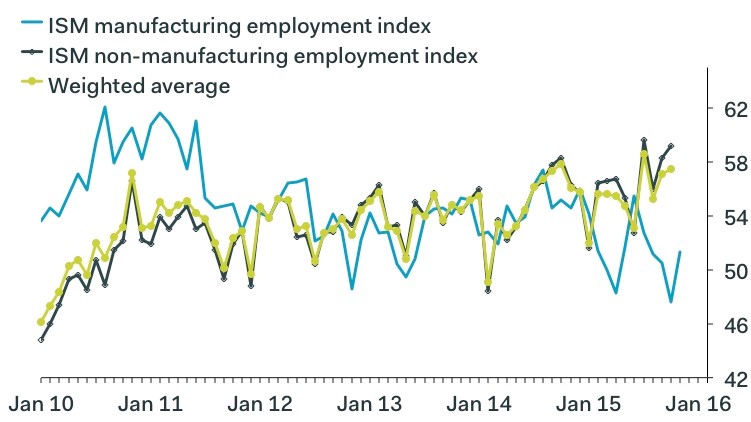

Economist Harm Bandholz of UniCredit says that the yawning gap between the service and manufacturing sectors is highlighted by the difference between the Institute for Supply Management’s indices for manufacturing and non-manufacturing activity, which is now the largest on record. You can see that spread in the black and blue lines in the chart below.

“Overall, the data releases this morning illustrate that while the dollar’s sharp rise over the past 15 months continues to weigh heavily on the manufacturing sector, the rest of the economy is doing fine,” writes Steve Murphy of Capital Economics. “This is beginning to look very much like a repeat of the mid-1990s, when a sharp rise in the dollar also pushed the ISM manufacturing index well below the 50 mark, yet headline GDP growth remained close to 3 percent.”

The ongoing malaise in manufacturing doesn’t mean the broader U.S. economy has to suffer the same fate.