The all-cash buyers that have ruled the real estate market since the market crash are making up a smaller share of purchases these days.

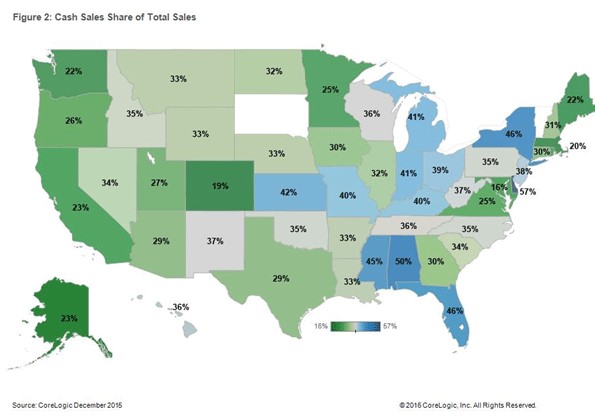

Last year, cash sales accounted for a third of all home sales, the lowest level since 2008, according to a new report from CoreLogic. Cash sales peaked in January 2011 when they made up nearly 47 percent of the market and have been trending lower since then.

Related: The 10 Best Cities for Middle-Class Families

CoreLogic projects that cash purchases will fall to 25 percent of sales — its historic average — by the middle of next year. That’s a good sign that real estate markets may finally be returning back to a more balanced market, after a nearly decade-long roller coaster ride.

Foreclosed properties drew the most cash buyers last month, with 60 percent of real-estate owned sales going to cash buyers, while a third of resales went to those making a purchase without a mortgage.

While easing credit has made it slightly easier for buyers to get a mortgage, those dependent on credit to finance a new home have struggled in some markets to compete with institutional investors and wealthy foreign buyers who promise a quick and easy close with an all-cash deal.

Real estate has also become a safe haven investment for those who don’t want to invest cash in volatile equity markets. Still, as home prices continue to rise, the return on investment becomes less appealing for those who aren’t planning to hold onto the property for the long-term.