The American government has historically given its implicit endorsement to the American dream of home ownership by providing valuable tax benefits to those who purchase a home.

In today’s market, however, those tax benefits -- namely the property tax and mortgage interest deductions -- have become much less valuable. For all but those buying the most expensive homes in markets with high property taxes, the tax benefits alone are not worth more than the standard deduction provided to married couples.

Related: 14 States With the Hottest Housing Markets

A new analysis by John Burns Real Estate Consulting, which provides data and advice to real estate investors, finds that for a typical homeowner -- with a 20 percent loan-to-value mortgage and a 1.5 percent property tax rate on a median priced home -- would be nearly $2,500 short of the standard $12,600 deduction. Without any other deductions, he’d have fallen short every year since 2008, the analysis finds.

The discrepancy reflects an increase in the standard deduction, which about 16 percent higher than it was in 2008, and a decline in mortgage interest rates, which have fallen by nearly half in the same period.

In focus groups with today’s potential homebuyers, the tax benefit of buying a home versus renting has far less prominence than it did for previous generations, says Steve Burch, a vice president with the consultancy.

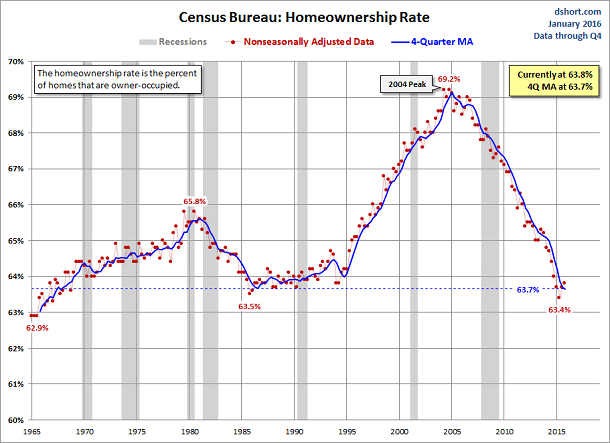

The U.S. home ownership rate fell below 64 percent last year, down from a high of 69 percent in 2004 and its lowest level since the early 1990s. Of course, as Burns mentions, there are other factors contributing to the falling rate, including tight inventory, falling affordability and high rents that make it difficult to save for a down payment.

Despite all those headwinds, Americans still overwhelming say they’d like to be homeowners. Two-thirds of those surveyed last summer by Wells Fargo said that home ownership is a dream come true or an accomplishment to be proud of. That may be true. It’s just not an accomplishment that will save you much on your taxes these days.