Health care has become so expensive in the United States that a growing number of Americans (and their employers) are finding it more cost efficient to fly across the globe for certain medical procedures. The savings are so great — and the quality high enough — that a handful of American insurance companies are now encouraging the practice and covering the travel and treatment costs.

Related: Here’s What’s Driving Health Care Costs Higher

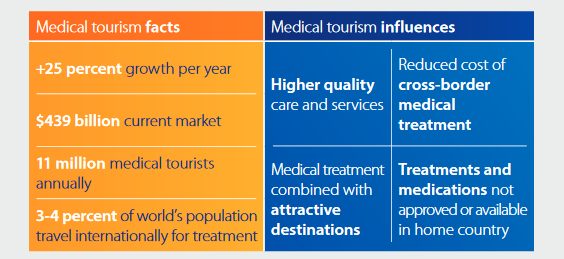

“Medical tourism” was valued at about $439 billion last year in a new report by Visa and Oxford Economics, which projected that it could grow 25 percent a year over the next decade. This year, an estimated 1.4 million Americans will leave the country for a medical procedure, according to Patients Beyond Borders.

In addition to traveling in order to save money, some medical tourists plan trips because they want to have a treatment that’s not approved in the United States or because they’ll have a shorter wait by going abroad.

If you’re considering joining them, here’s what you need to know:

1. The potential savings are huge. For patients considering procedures that aren’t covered by insurance, traveling abroad for treatment can yield serious savings. A knee replacement, for example, which would cost $35,000 to $60,000 in the United States, costs less than $23,000 in Costa Rica or India, including airfare and lodging for the patient and a companion, according to Indus Health, which helps employers offer medical tourism benefits to their workers. Other popular procedures for travelers include In vitro fertilization, dental work and cosmetic surgery.

Source: Visa, Mapping the Future of Global Travel and Tourism

Hospitals overseas can often charge lower prices because their doctors are paid less, and they may not have to carry the same medical malpractice insurance as American doctors. And if most patients are paying with cash, they don’t have to worry about tiered pricing for preferred insurance companies.

2. There are still serious risks. In addition to trouble arising from language barriers and culture shock, the standard safety practices in the United States may not be used in international hospitals. You may be more likely to receive counterfeit medications or blood that hasn’t been properly screened than you would here, according to the Centers for Disease Control.

Related: 1 in 5 People with Health Insurance Can't Afford Their Medical Bills

Jet lag can also leave you weaker going into surgery or impede your recovery when you get home. If something goes seriously wrong, it may be more difficult to bring a malpractice suit against international health care providers, and even if you can bring a suit there are much lower limits to how much you can sue for internationally. You also may not have the same privacy protections afforded to you in the United States under HIPAA rules.

3. Consider medical complications insurance. If your traditional insurance won’t cover the trip, you may need to purchase medical complications insurance, which will cover the cost of follow-up care and treatment if your procedure results in complications. Traditional travel insurance typically doesn’t offer such coverage.

4. Do your homework. Look for a hospital that’s used to handling international patients and that’s accredited by the American Association for Accreditation of Ambulatory Surgery Facilities or the Joint Commission International. You’ll want a doctor who speaks English and who went to medical school in a first-world country. “The people who get into trouble are the ones that price shop and don’t pay attention to quality,” says Josef Woodman, chief executive officer of Patients Beyond Borders.

If that sounds like too much work, there are several medical tourism agencies now that will coordinate the trip and who have established relationships with specific doctors and hospitals. You may pay slightly more for the procedure, but you’ll have someone you can call if any issues arrive during or after your treatment. Check out online reviews and the Better Business Bureau to see whether an agency has a good reputation. The agencies often also sell complications insurance.

Related: Medical Error Is Killing Hundreds of Thousands Each Year

5. Plan for your recovery. Depending on your procedure, you may need to stay abroad for several weeks. Make sure that your hotel knows that you’ll be recovering from a medical treatment and can accommodate any special needs you might have. Even if you’re feeling better, the CDC recommends that you not fly for at least 10 days after surgery due to the increased risk of blood clots. You should also avoid typical vacation activities like sunbathing, swimming or drinking alcohol.

Be sure to bring home all of your discharge papers from the hospital, as well as records for blood work, X-rays or other screenings. “That way if you need follow-up care, you can bring those documents to a doctor who might have been reluctant to treat [and who] will have a roadmap and the confidence to go forward,” Woodman says.

6. Involve your doctor. You’ll want to consult with your current doctor before seeking treatment abroad. You may need her to provide medical records or consult with your international team, and you’ll also likely follow up with her for ongoing treatment or checkups after you return. “Talk to your doctor before you leave about the surgeon you’ll be seeing, the devices used, the recovery time,” says Maria Burpee, senior vice president of special products with ArchimedicX, an international hospital search engine and booking tool. “Then they can go over it with you and make a plan with your doctor for follow up care.”

7. Consider domestic options. Given the wide range of health care procedures within the United States, you may be able to find the treatment that you need at a more affordable price without leaving the country. A knee replacement, for example, costs an average $61,300 in New York City compared to just $16,000 in Montgomery, Alabama, according to Blue Cross Blue Shield.