Continued strength in the economy and the housing market, along with a loosening of credit, are inspiring more Americans to make improvements to their homes. The downside to all this activity is that it’s getting harder for consumers to get a deal on a renovation project.

The construction industry doesn’t have enough workers to meet the increased demand and the workers they do have are demanding higher pay, all of which is pushing up prices for consumers.

Half of general contractors, remodelers and design-build firms surveyed by Houzz in the third quarter cited increased costs in hiring subcontractors, while 37 percent said that they were paying their own employees more.

Source: Houzz

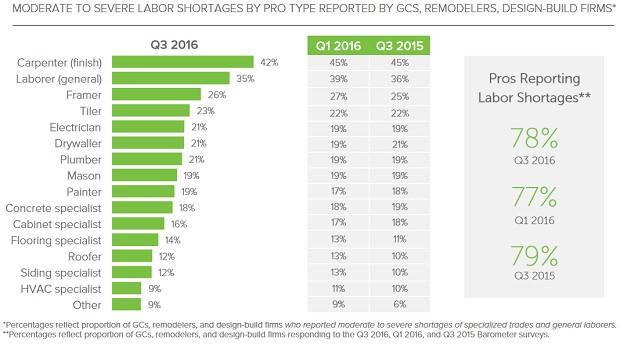

Eight in 10 of the companies surveyed said that they had experienced moderate to severe labor shortages, with the carpenters representing the workers in the shortest supply.

The 2016 Cost vs. Value report from Remodeling Magazine found that renovations costs were up across the board, with the average project costing nearly 5 percent more than last year.

Related: The Worst Home Improvement Projects for Your Money

The Houzz study found that six in 10 companies surveyed had increased the prices that they charge to customers, and half of firms said it was taking longer to complete projects.

The higher prices aren’t deterring consumers. They’re expected to spend more than $320 billion on renovating and improving their homes this year, according to Harvard University’s Leading Indicator of Remodeling Activity.

That would put remodeling activity just shy of its inflation-adjusted peak -- reached shortly before the housing crash in 2006. The projected 8 percent growth rate by the start of 2017 is far higher than the historical average growth rate of 4.9 percent. Does that mean that the housing market is headed for another crash? There are no clear signs of trouble yet, but it’s worth keeping the historical precedents in mind if you’re considering jumping into real estate.