There are plenty of unknowns as the nation looks ahead toward a Donald Trump presidential administration paired with a Republican-dominated Congress, but one thing that seems fairly certain is that there will be considerable pressure to rewrite the federal tax code in fairly dramatic ways. Both Trump, during his campaign, and House Republicans, in June, released fairly detailed descriptions of what they would propose, and while they aren’t identical, both would move policy in the same direction across a broad range of tax and budget questions.

Assuming that Trump and House Speaker Paul Ryan are able to rally Republicans behind some sort of melding of their respective plans, the short version of what to expect is this:

Related: Ryan Declares GOP Has a ‘Mandate’ to Enact Sweeping Changes

-- On income taxes: Very good news for the wealthy, who would benefit in vast disproportion to the rest of the country from proposed tax cuts. Little net change for low- and middle-income taxpayers.

-- Business taxes: Excellent news for businesses, which would see a slashing of the corporate income tax and likely a move toward “destination based cash flow” taxation of profits, meaning that only income from the domestic sales of goods and services would be taxed.

-- On the budget deficit: Terrible news for anybody who cares about bringing spending in line with federal revenue. Experts say that either proposal would drive up the federal deficit drastically as compared to current law.

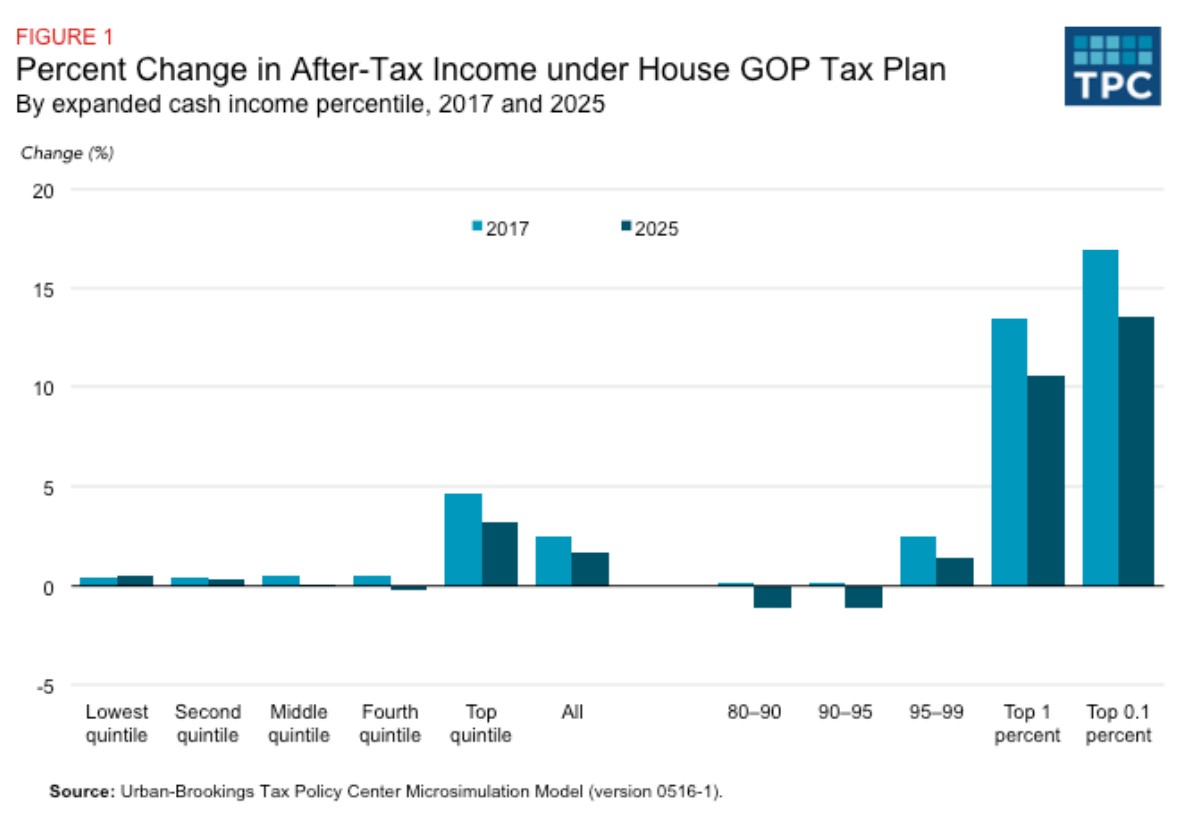

Independent analyses of both the Trump income tax proposals and the House Republican proposals show that they would both concentrate tax cuts on the very wealthiest of the wealthy, and that the concentration in benefits would increase over the years until it was effectively all going to top earners.

Related: Despite Differences, President Obama Asks Americans to Unite Behind President Elect Trump

According to the Urban-Brookings Tax Policy Center, the House plan “would cut taxes at every income level in 2017, but high-income taxpayers would receive the biggest cuts, both in dollar terms and as a percentage of income.”

The analysis continues, “Three-quarters of the tax cuts would benefit the top 1 percent of taxpayers and the highest-income taxpayers (0.1 percent of the population, or those with incomes over $3.7 million in 2015 dollars) would experience an average tax cut of about $1.3 million, 16.9 percent of after-tax income. Households in the middle fifth of the income distribution would receive an average tax cut of almost $260, or 0.5 percent of after-tax income, while the poorest fifth of households would see their taxes go down an average of about $50, or 0.4 percent of their after-tax income. In 2025, the top 1 percent of households would receive nearly 100 percent of the total tax reduction.”

The Trump proposal, by comparison, “would cut the average tax bill in 2017 by $2,940, increasing after-tax income by 4.1 percent. However, the highest-income taxpayers (0.1 percent of the population, or those with incomes over $3.7 million in 2016 dollars) would experience an average tax cut of nearly $1.1 million, over 14 percent of after-tax income.

“Households in the middle fifth of the income distribution would receive an average tax cut of $1,010, or 1.8 percent of after-tax income, while the poorest fifth of households would see their taxes go down an average of $110, or 0.8 percent of their after-tax income.”

Related: Can Trump the Disruptor Become Trump the Uniter?

On the issue of business taxes, both the Trump plan and the House plan would slash the current 35 percent tax on business income, to 15 percent and 20 percent, respectively. Both would allow businesses to write off (expense) business investment immediately. The House proposal offers a plan to finally bring US taxation of businesses’ foreign income in line with other developed countries, by taxing only the income from domestic sales and imports. Most experts see that as a largely welcome move away from a system that encourages businesses to shift production overseas.

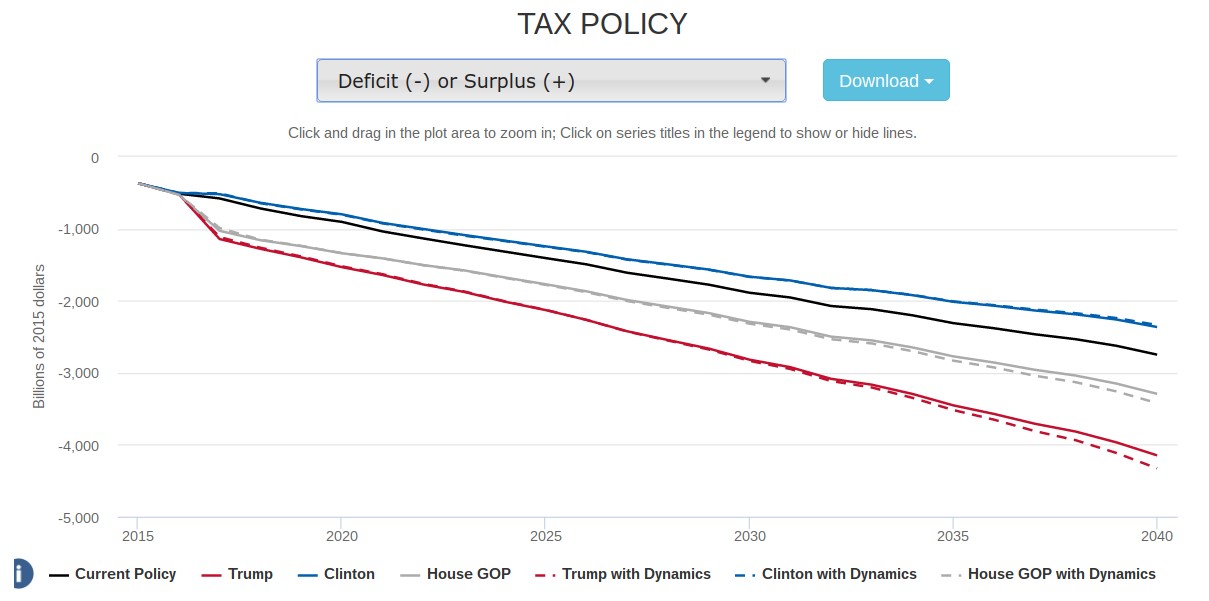

The dramatic reduction in both personal and business income tax revenue would have a dramatic impact on the federal budget deficit.

The Penn Wharton Budget Model estimates that, absent completely unrealistic levels of spending cuts, both the Trump plan and the House plan would sharply increase the deficit in the short run, and would continue to add to it at a greater rate than sticking to current law -- a policy many budget experts already consider unsustainable.

Related: 5 Reasons Why Trump Won the Election

For budget hawks, the prospect of any of the House tax reform policy, the Trump policy, or a hybrid of the two becoming federal policy is creating some alarm.

The Committee for a Responsible Federal Budget has declared the Trump’s overall policy agenda as “far from fiscally responsible.” On taxes in particular, CRFB says, “our estimate shows his tax policies would cost about $4.5 trillion over a decade” and adds, “Although one of the stated goals of his tax plan is to pay for rate reductions by reducing tax breaks, every published analysis of the plan has found that the size of the tax cuts greatly outweighs the offsets, even when optimistic levels of growth are considered.”

While the CRFB analysis of the House plan wasn’t quite as negative, it notes that all major analyses of the plan find that claims to revenue neutrality to the contrary, “it would fall short on revenue because it explicitly aims for a lower revenue target than the current tax system would meet” and offers nothing in the way of a move toward deficit reduction.