Since they’re more likely to work fewer years and earn less money, women are already at a disadvantage to men when it comes to retirement savings. Compounding that discrepancy, women typically live longer than men, which means that they need to stretch fewer dollars over a longer period of years.

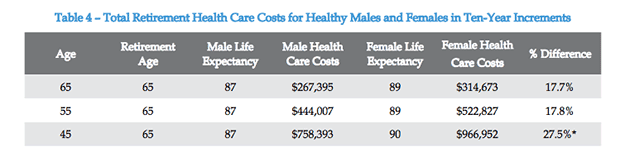

A new paper from HealthView Services finds just how daunting a task that can be. A healthy 65-year-old woman with an average life expectancy faces total out-of-pocket health care costs of $315,000 over the course of her retirement, excluding long-term care, compared to $267,000 for men, the report finds – an 18 percent difference.

Related: A New Plan to Save Social Security for Another 75 Years

“Living longer is both a blessing and a curse for women when it comes to health care,” Ron Matrogiovanni, founder and CEO of HealthView Services said in a statement. “Health care costs for women and men, are, on average, very similar during our lifetimes, however, because women live longer, they will have more years to pay premiums and other out-of-pocket costs.”

Women are, on average, 2.3 years younger than their husbands, and have a life expectancy that’s two years longer. That means they may be responsible for four additional years of health care expenses in retirement in their final years, when health care tends to be the most expensive, and after savings may have been depleted to care for a spouse.

The paper recommends that women and couples work with advisers to create financial plans that address these issues, using tools such as Health Savings Accounts and 401(k) contributions, and considering long-term care insurance.