As Washington fiddles, China is investing billions in U.S. startups with cutting-edge products that could have military applications at the same time it is dialing back investments in less critical American industries such as entertainment.

A New York Times story this week says that among the startups are companies working on artificial intelligence for military robots, rocket engines, ship sensors and printers that could produce high-tech components such as computer screens for military jets. Many of the firms making such investments are owned by companies controlled by the Chinese government or connected to its leaders.

Related: Pentagon Scientists Worry the US Is Losing the Artificial Intelligence Arms Race

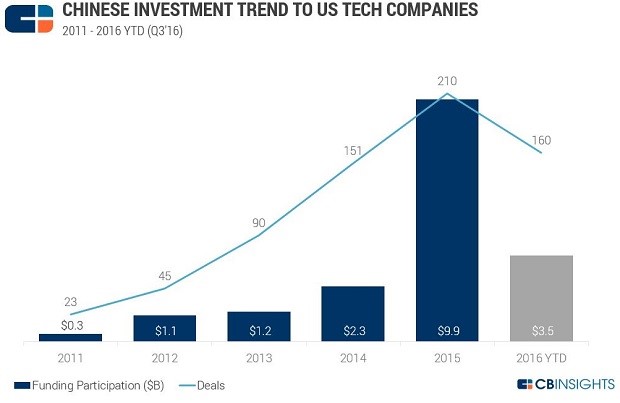

A blog post last December on the website of CB Insights, which tracks startup investments, says that China poured $9.9 billion into new Silicon Valley firms in 2015 and made an additional $3.5 billion in tech investments in the first nine months of last year. The number and size of those tech investments in startups developing military applications were not broken out.

The Times story says a Defense Department white paper being circulated among Trump administration officials makes the case that “Beijing is encouraging Chinese companies with close government ties to invest in American start-ups specializing in critical technologies like artificial intelligence and robots to advance China’s military capacity as well as its economy.” A call to the Defense Department for comment was referred to a public affairs officer who was not immediately available.

Last year, China spent $225 billion investing in or buying out overseas companies, although there is evidence that the leadership in Beijing is exerting pressure to both rein in outflows of capital and ensure that when investments are made, they are in strategic industries.

Related: China Will Own New Year’s Eve in Times Square

For example, one casualty of more controlled investment may have been the $1 billion deal by Dalian Wanda Group to buy Dick Clark Productions, which produces a popular New Year’s Eve countdown show and the Golden Globe Awards ceremony, among other entertainment properties.

Eldridge Industries, which owns Dick Clark Productions, moved to terminate the deal earlier this month after contending that Wanda, which has been aggressively pursuing investments in Hollywood, was unwilling to meet its obligations. Earlier this week, the New York Post reported that a $1 billion financing deal between Viacom’s Paramount Pictures and two Chinese companies, Shanghai Film Group and Hua Hua Media, is in jeopardy.

What is driving the Chinese interest in U.S. startups focused on AI and robotics with military applications seems to be a recognition that the parameters of war and defense are rapidly evolving.

A report prepared last October for the U.S.-China Economic and Security Review Committee, which monitors the national security implications of trade and deals with China, said that “Chinese military leaders and strategists believe that the nature of warfare is fundamentally changing due to unmanned platforms” and pointed to a growing military drone industry and efforts to acquire artificial intelligence capabilities either by investment or possibly “cyber espionage.

Related: Game of Drones: The Air Force Ramps Up Video Game Warfare

The study conducted by the intelligence research and analysis firm Defense Group Inc. said: “Chinese strategists consider the U.S. military to be increasingly dependent upon unmanned systems, making countermeasures against these weapons a necessity.”

Besides attempting to acquire military technology illegally or through means that are not clearly regulated, DGI said “state-owned conglomerates, companies, and venture capital firms are actively acquiring and investing in AI and foreign robotics technologies companies, particularly in Europe.”

The report recommended that Washington “monitor and when necessary investigate China’s growing foreign investments in robotics and AI companies and consider the security implications of transactions and acquisitions involving emerging technologies such as AI and nanorobotics.”

Investigating Chinese investments, however, may not address the root problem. Some startups told the Times that they turned to Chinese investors because they were more willing to take risks and because the American military has been reluctant to take a chance on unproven technology even when the capital required is relatively insignificant.