In a report to Congress this week, U.S. Comptroller General Gene L. Dodaro voiced alarm over steadily mounting government overpayments for Medicare, Medicaid and Earned Income Tax Credits that are complicating efforts by Congress and the administration to contain the budget deficit.

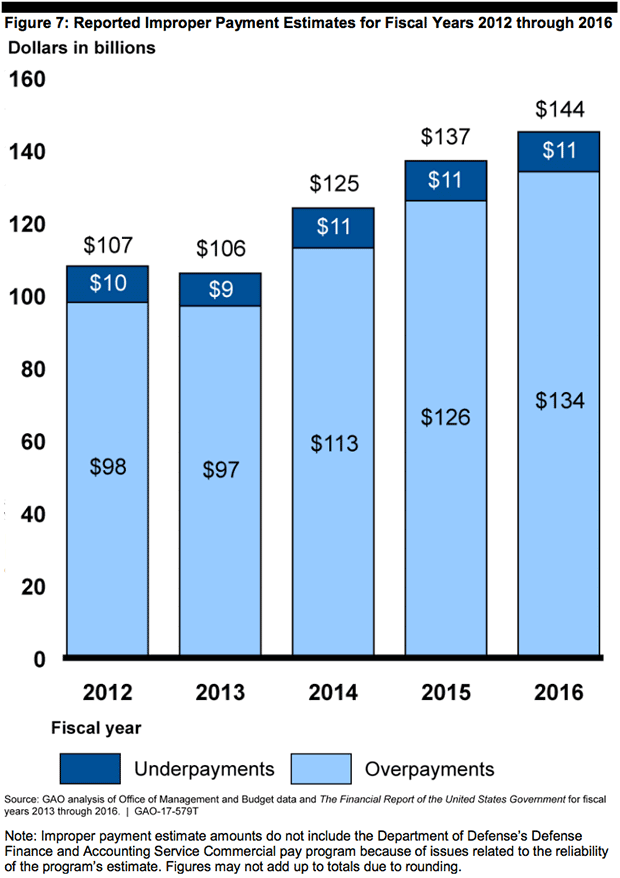

Last year alone, the government made a total of $144.3 billion in improper or unjustifiable payments, including $59.7 billion in Medicare reimbursements, $36.3 billion in Medicaid billings, and $16.8 billion in refundable tax credits for poor working families and individuals.

Since fiscal 2013 – when many agencies began reporting improper payments for the first time -- cumulative improper payments have totaled over $1.2 trillion, according to the Government Accountability Office.

Related: Budget Watchdog to Trump: Government Spending Is on an Unsustainable Path

“Improper payments remain a significant and pervasive government-wide issue,” Dodaro said in testimony Wednesday before the House Budget Committee. “For several years, we have reported improper payments as a material weakness in our audit reports on the consolidated financial statements of the U.S. government.”

As one measure of the scope of the problem, Dodaro said that the combination of erroneous government program payouts and income tax delinquency or underpayments accounted for more than 93 percent of the 2016 federal budget deficit and exceeded the 2015 deficit by more than $110 billion.

The federal deficit in fiscal year 2016 increased to $587 billion — up from $439 billion in FY 2015. Federal receipts grew a modest $18 billion during that period due primarily to extensions of tax breaks and loopholes, but that was eclipsed by a $166.5 billion increase in spending, driven by Social Security, Medicare, Medicaid and interest on the publicly held debt.

GAO estimated that the government-wide improper payment error rate was 5.1 percent of related program outlays, and that didn’t include the Pentagon’s massive Defense Finance and Accounting Service. Although the overpayments were concentrated in the Medicare and Medicaid programs for the elderly and the poor and the Earned Income Tax Credit, programs in 22 other agencies accounted for $31.7 billion of last year’s overpayments.

Related: The Problem with Low-Income Tax Credits: Billions in Improper Payments

Dodaro, a prominent deficit hawk alarmed by the Congressional Budget Office’s long-term projections of a steadily mounting federal debt, used his testimony to urge Congress and the Trump administration to temper their spending and tax cut initiatives in the face of “unsustainable” fiscal trends.

Without major changes in policy, such as Congress approving higher taxes or reforms to Social Security, Medicare and other major entitlements, the deficit is projected to grow considerably in the coming decade as a share of the overall economy.

“Decisions over the near term to enhance economic growth and address national policies need to be accompanied by a broader fiscal plan to put the government on a more sustainable long-term path,” he said. “This is essential to ensure that the United States remains in a strong economic position to meet its security and social needs as well as to preserve flexibility in addressing unforeseen events.”