While Senate GOP leaders await the latest Congressional Budget Office analysis of their plan to repeal and replace the Affordable Care Act, a new report from the Urban Institute’s Health Policy Center and the Urban-Brookings Tax Policy Center may add to their headaches in trying to win passage of the measure.

CBO in late May provided a preliminary assessment of the Senate’s proposed Better Care Reconciliation Act (BCRA) that alarmed many Republican moderates by projecting losses of insurance coverage for 22 million people by 2026 – similar to the impact of a House-passed version – and rising premiums for several years before they begin to subside.

Related: Here’s What a Bipartisan Health Care Deal Might Look Like

Like the House-passed bill, the Senate plan would be especially tough on low-income and disabled people, who would stand to lose either expanded Medicaid or traditional Medicaid coverage because of deep cuts and roll backs in the program. Moreover, many consumers who are older but not yet eligible for Medicare would struggle with diminished federal subsidies to purchase health insurance in the individual markets.

The BCRA would also eliminate the Obamacare cost-sharing reductions and limit premium tax credits to people with incomes up to 350 percent of the federal poverty line. Tax credits would vary by age and income. By comparison, the Affordable Care Act provides tax credits based on income, with cost-sharing reductions that reduce out-of-pocket health care costs for people with incomes up to 250 percent of poverty. Out-of-pocket costs for plans with tax credits would be substantially higher under the BCRA.

Finally, the Senate bill would repeal nearly $800 billion of Obamacare-related taxes, providing relief to wealthier Americans and to the pharmaceutical, insurance and health care industries. In short, the bill would be boon to wealthier and healthier people, and a setback for poorer and sicker people.

A new Urban-Brookings analysis released on Tuesday provides a more detailed assessment of the overall distributional effect of the legislation.

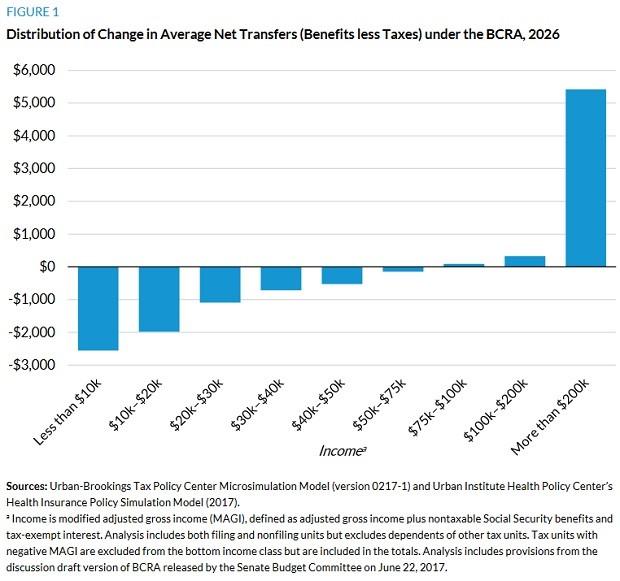

The bottom line is that the proposed BCRA “significantly benefits high-income families and significantly worsens circumstances for low-income families,” according to the study.

Related: Why Republicans Can’t Just Move on From Their Health Care Nightmare

By creating an economic model that simultaneously takes into account the effects of tax relief and benefit reductions, the economists found that the average family with less than $10,000 of income in 2016 would be $2,550 “worse off” -- a net reduction of more than 60 percent of the family’s income. By contrast, the family with annual income of more than $200,000 in 2026 would be $5,420 “better off,” with a net gain of one percent of the family’s income.

Other findings:

- Families with incomes of more than $1 million a year would reap most of the gains. Their average gain would be more than $49,000, or a 1.5 percent increase in income.

- Families with incomes of more than $200,000 would claim 84.6% of the overall tax reductions in 2026. Those families with annual incomes above $1 million would reap 58.9% of the tax benefits.

- Families with incomes below $30,000 a year would incur 74.4% of the losses in health benefits, including government premium subsidies and Medicaid coverage.

- Families with incomes below $75,000 a year would experience net tax and benefit losses, in general, while families with incomes above that figure would be winners under BRCA.