President Trump’s proposed budget for fiscal 2018 already has encountered stiff resistance from Republicans and Democrats alike and is unlikely to be embraced in its entirety when the House and Senate finalize new budget blueprints and spending bills for the coming year.

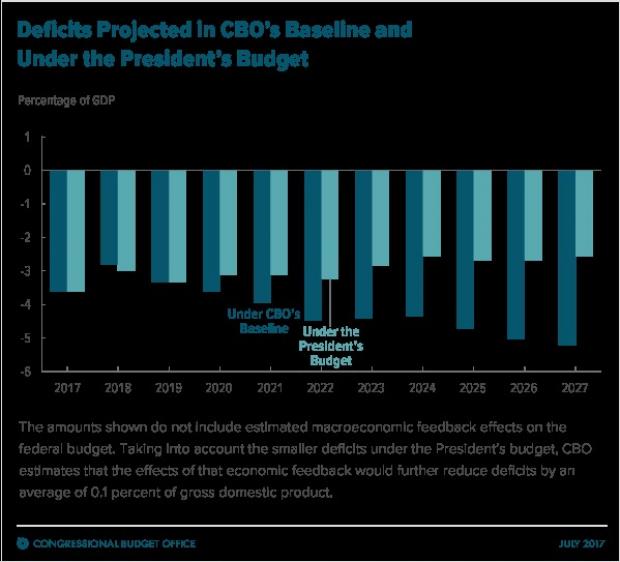

However, if Congress were to adopt major portions of the plan, federal budget deficits would shrink relative to the size of the overall economy in the coming decade, while the cumulative federal deficit would be nearly a third smaller than currently projected by government analysts, according to a study issued Thursday by the Congressional Budget Office (CBO) and the Joint Committee on Taxation (JCT).

Related: The Five Biggest Winners and Losers in Trump’s 2018 Budget

Indeed, by the end of the coming decade, the debt held by the public would total 80 percent of Gross Domestic Product, or 11 percentage points below the debt-to-GDP ratio projected in CBO’s current baseline, which assumes no change in current law.

But far from achieving a balanced budget in the coming decade, as Trump and his economic advisers have brazenly promised, the president’s budget plan would continue to foster substantial deficits for as far as the eye can see, according to the new CBO-JCT report.

Trump’s budget plan, “A New Foundation for American Greatness,” unveiled in late May, shows the annual deficit gradually vanishing from an estimated $440 billion in fiscal 2018 to $319 billion in 2023 to a $16 billion surplus by 2027.

By contrast, CBO’s analysis of Trump’s budget plan shows the deficit steadily rising from $593 billion in fiscal 2018 to $720 billion in fiscal 2027. Trump’s spending and tax plans would reduce annual deficits by a cumulative total of $3.3 trillion over the coming decade, rather than the $5.6 trillion of total deficit reduction claimed by the administration.

Related: Trump’s ‘Hard Power’ Budget Gives Billions to Defense, Guts Domestic Programs

The newly released analysis highlights a major chasm between CBO’s more traditional analysis of the effects of spending and tax policy on the long-term deficit and debt and what many view as the Trump administration’s overly rosy forecasts of future revenue growth and government savings under the president’s policies.

While the CBO gives the administration some credit for the “dynamic” effect of proposed tax cuts and savings on long term economic growth, it has largely treated many of Trump’s most ambitious proposals – including more than $7 trillion of proposed tax cuts for businesses and individuals —as works in progress that can’t be fully accounted for in projecting long term deficits.

During a press briefing today, CBO officials repeatedly referred to “place holders” in their analysis that reflect uncertainty about precisely what Trump and his advisers have in mind.

What’s more, CBO and the Trump administration differ substantially in projecting economic growth, with Treasury Secretary Steven Mnuchin and others predicting three percent growth in GDP in the coming years compared to CBO’s far less optimistic forecast of 1.9 percent growth. A higher growth rate would result in more tax revenues pouring into the government’s coffers.

Related: Trump Could Face His First Fiscal Crisis Over Raising the Debt Ceiling

In describing the big difference between Trump’s and CBO’s deficit projections for the coming decade, CBO officials wrote, “Nearly all of that difference arises because the Administration projects higher revenue collections—stemming mainly from a projection of faster economic growth.”

This isn’t the first time that the nonpartisan CBO has issued pronouncements that contradicted claims of the White House and the Republican-controlled Congress. Trump advisers and some GOP congressional leaders were outraged by CBO’s recent analyses of House and Senate GOP proposals to repeal and replace the Affordable Care Act that predicted that as many as 23 million Americans would lose their coverage in the coming years and that health care premiums would rise even more before finally plateauing.

Trump’s budget calls for $4.1 trillion in overall spending in fiscal 2018, including massive increases in defense, veterans’ programs, and homeland security but deep cuts in health care, entitlements, and social safety-net programs for the poor.

Related: Why Trump’s Tax Cut Would Be a Tough Sell to the Poor and Middle Class

According to CBO’s calculations, the president’s budget over the coming decade would achieve $4.2 trillion of savings, including $2 trillion of cuts in mandatory programs including Medicare and Medicaid, $1.9 trillion of savings in discretionary programs and government operations, and $300 million of reduced interest on the national debt.

The president’s “America first” themes echo throughout the budget, with its strong emphasis on rebuilding the military, cracking down on illegal immigrants and potential terrorists, and tightening national security by building a wall along the southern border with Mexico.

The budget calls for a 10 percent increase in defense spending – which would require breaching a legal cap on defense– as well as $2.6 billion for border security and $1.6 billion in a first down payment on construction of the wall that Trump once falsely insisted would be paid for by the Mexican government.