House Republicans are reportedly working on a deal to keep the federal deduction for state and local taxes in some form.

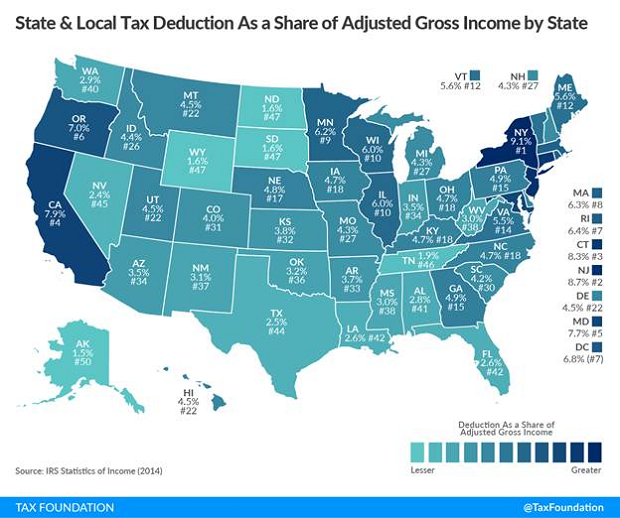

The GOP tax reform blueprint released last month called for the break to be eliminated, helping cover some of the other costs of the plan. But the proposal met with immediate resistance from lawmakers representing high-tax states like New York, New Jersey and California. President Trump isn’t happy with it either – he “grew angry” recently when he learned that the proposal in his plan would squeeze some middle-class taxpayers, according to Bloomberg.

The GOP’s dilemma: Ending the tax break raises revenue but could cost enough votes in Congress to torpedo the tax reform plan. About two dozen House Republicans have reportedly expressed concern about eliminating the deduction. “This is probably the biggest obstacle they have to overcome to get to 218,” the vote total needed for a bill to pass in the House, Rep. Peter King (R-NY) told Bloomberg. “Right now, they can’t get there without us.” But keeping the tax break costs money, and it’s not clear how to make up for the lost revenue without adding to the deficit, also potentially sinking the plan.

One option under consideration is to allow middle-class families to continue claiming the deduction but prevent high-earning taxpayers from benefiting. “Other options under consideration include allowing deductions for property taxes but not for state and local income taxes, or capping the overall amount of deductions households can take on state and local taxes,” The Wall Street Journal reports.

If the deduction is kept only for middle-class taxpayers, the key question then becomes: Who qualifies? Regional differences may make it hard to settle on a dividing line. “For some GOP members of Congress, a middle income household tops out at $100,000 a year,” according to Bloomberg. “For others, a family making $400,000 still deserves a break.” People earning more than $100,000 a year accounted for about two-thirds of the SALT deductions claimed in 2014, according to the Tax Policy Center.

Negotiations in Congress have apparently narrowed the range to somewhere between $200,000 and $400,000 a year. Imposing a limit of $400,000 in adjusted gross income would raise $481 billion in revenue over 10 years, according to the Tax Foundation, compared to $1.8 trillion generated by a full repeal of the deduction.

Why Democrats Want to Save SALT Too

According to Business Insider’s Josh Barro, “The state and local tax deduction serves two policy purposes. The obvious one is to ease the federal tax burden on families that pay a lot of state and local taxes. The other purpose of the deduction is to make it easier for states and localities to levy taxes. If taxpayers get a partial rebate on their federal taxes for every additional dollar of tax that a state or locality collects from them, they're less likely to object to tax increases or to move away because of them. This second purpose explains why Democrats are so attached to the tax deduction, even for higher-income taxpayers on whom you might expect them to support a tax increase.”