The International Money Fund’s latest global fiscal survey warns that in five years, the U.S. debt-to-GDP ratio will be higher than Italy’s, a nation not generally known for its exemplary fiscal discipline. The IMF estimates that the debt ratio will rise to 116.9 percent by 2023, while Italy’s will fall slightly to 116.6 percent. Bloomberg notes that at those levels, U.S. will have a higher debt burden relative to the economy than both Mozambique and Burundi.

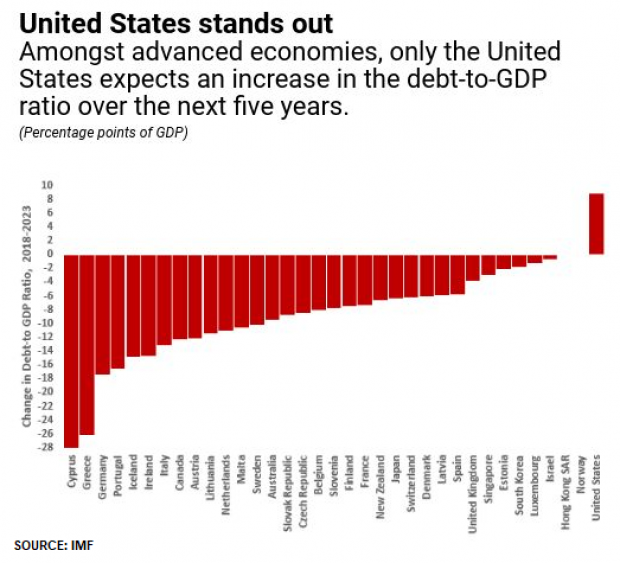

The U.S. stands alone among the advanced economies, since virtually all developed nations are expected to reduce their debt-to-GDP ratios over the next half decade, following years of rising debt in the wake of the global financial crisis. The U.S. is the only country that is adding government debt rather than paying it down.

Vítor Gaspar, director of fiscal affairs at the IMF, told The Guardian that overall global debt levels are rising, though most of that growth is occurring in China and low-income countries. The U.S. situation is exceptional, and the IMF doesn’t believe that the $1.5 trillion in tax cuts passed by Republicans will pay for themselves. Gaspar sounded a note of caution, and called for countries to make fiscal hay while the sunshine of strong economic growth is still shining. “We urge policymakers to avoid pro-cyclical policy actions that provide unnecessary stimulus when economic activity is already pacing up,” he said.

“The economic upswing should be used to accumulate fiscal buffers for tempestuous times that will eventually come.”