Republicans insisted that their tax cuts on pass-through entities were meant to reduce the tax burden on small businesses and thus spur job creation. But updated estimates from the Joint Committee on Taxation in advance of a Senate Finance Committee hearing on the new tax law Tuesday afternoon, show that the “small business” tax cut will largely benefit the wealthy — many of whom aren’t “job creators.”

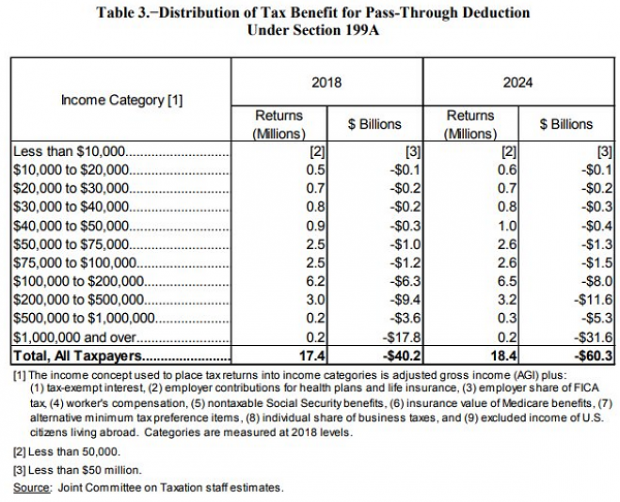

According to the new estimates, 44 percent of the new tax benefit for pass-through business owners, some of whom can now deduct 20 percent of their business-related incomes, goes to households earning $1 million or more a year, The Wall Street Journal’s Richard Rubin points out. (That’s $17.8 billion in benefits for those high-income households, out of a total of $40.2 billion for all income groups.)

The new estimates include projections from the Congressional Budget Office that were not available to the JCT back in February, when the committee produced its initial analysis.

Drilling down further, more than half of the pass-through benefits ($21.4 billion, or 53 percent) go to households earning $500,000 and higher, and more than three quarters ($30.8 billion, or 77 percent) goes to households earning $200,000 and higher.

At the opposite end of the income spectrum, households earning less than $100,000 are expected to claim about 7 percent of the benefit ($3 billion).

The rules around the new pass-through deductions have been criticized for being both confusing and unnecessary (see NYU law professor Daniel Schaviro’s withering take here). Rubin attempted to explain some of the basics in a new video on Monday, which you can entertain yourself with (or not) on YouTube.

The JCT tables are available here, and live video of Tuesday’s Senate Finance Committee hearing, entitled “Early Impressions of the New Tax Law,” will be available here, with a scheduled start time of 2:30 p.m. EST.