The federal budget is on an unstable path in the long run and the Trump administration has made things worse with its tax cuts and spending increases, warn C. Eugene Steuerle and Caleb Quakenbush of the Urban Institute.

Despite campaign promises to improve the nation’s spending and revenue shortfalls while investing in health care and infrastructure, the White House and Congress have done nothing to alter the long-term trend in which “fiscal policy has increasingly disfavored workers, young adults, children, education, and research,” Steuerle and Quakenbush write.

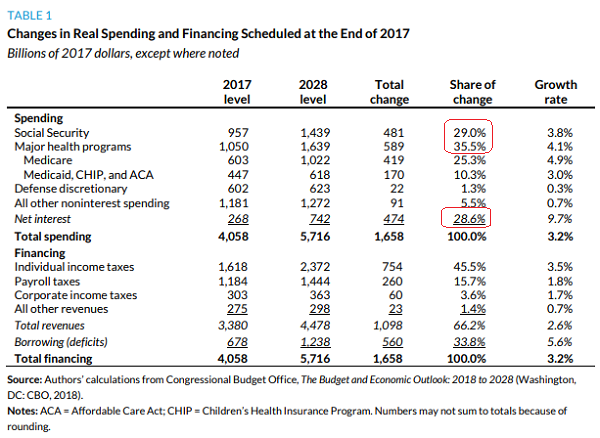

As a result of both the long-term trends and new policies implemented in the first year of the Trump administration, over the next decade, “nearly all growth in spending will go toward higher health, Social Security, and interest costs—with little left for almost everything else: infrastructure, research, education, defense, housing, and most basic government functions.”

The largest source of higher spending over the next 10 years will be health care, with Medicare and Medicaid accounting for about 35 percent of the increase in federal outlays. Social Security will claim about 29 percent of the growth in spending, and interest payments – now the fastest growing part of the budget – will account for about 28 percent. Revenue increases will cover only about two-thirds of the increased spending, the authors say, pushing debt to “unprecedented peacetime levels.”

If current projections hold and no substantial changes are made to fiscal policies, the U.S. will be unable to make much-needed investments in education, infrastructure and health care, leaving the country “with the prospect of fewer educators, soldiers, scientists and administrators, as well as fewer workers to maintain infrastructure, government equipment, and its investments in everything from IT to research.”