House Republicans released a 2019 budget proposal Tuesday that, though it stands little chance of advancing, signals the party’s priorities: The blueprint would balance the budget in nine years by making steep cuts to mandatory spending programs including Medicare and Social Security, which President Trump has pledged not to cut, and by factoring in what some analysts call overly optimistic growth projections.

Here’s what you need to know:

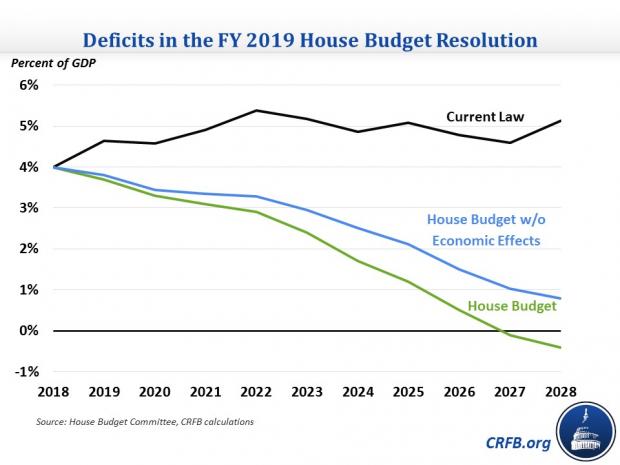

Deficit reduction: The budget “seeks to revive the deficit-cutting mantle for Republicans,” Bloomberg’s Erik Wasson writes, after the GOP’s tax law and a bipartisan $1.3 trillion spending bill dramatically increased projected deficits over the next 10 years. The new budget resolution calls for $8.1 trillion in deficit reduction over a decade, including $5.4 trillion in mandatory spending cuts. Reconciliation instructions call for congressional committees to find at least $302 billion in cuts to mandatory spending, but the rest of the reductions are left for future lawmakers.

“The time is now for our Congress to step up and confront the biggest challenge to our society,” said House Budget Chairman Steve Womack (R-AR). “There is not a bigger enemy on the domestic side than the debt and deficits.”

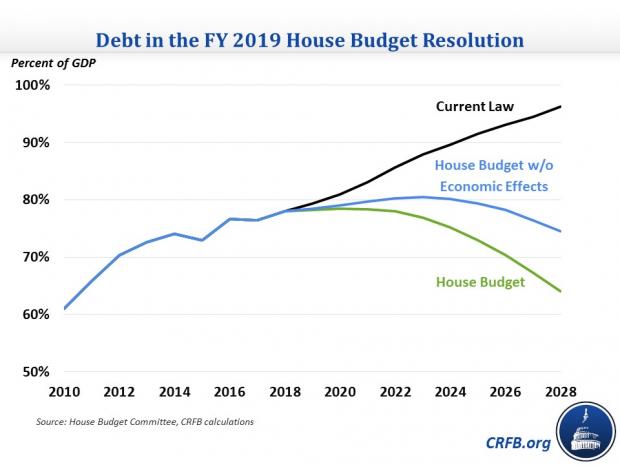

The debt: Under the budget proposal, debt held by the public would still rise from $15.5 trillion to $20.6 trillion in 2028. As a share of the economy, debt would drop from a current 78 percent of GDP to 64 percent in 2028. The Committee for a Responsible Budget says that, without some rosy economic assumptions — “The budget seems to assume average annual real GDP growth of 2.6 percent per year over ten years, compared to 1.8 percent in CBO's baseline” — debt would fall to about 75 percent of GDP in 2028.

Key spending levels: The budget maintains the discretionary spending targets for next year (a 3 percent increase over 2018) that Congress, as part of a bipartisan two-year deal, agreed to in February. Longer term, the budget projects that discretionary defense spending will rise from $647 billion in 2019 to $736 billion by 2028. Overall, the draft calls for a $645 billion spending increase over 10 years.

Discretionary domestic spending would fall from $597 billion in 2019 to $555 billion in 2021 and stay frozen at that level through 2028.

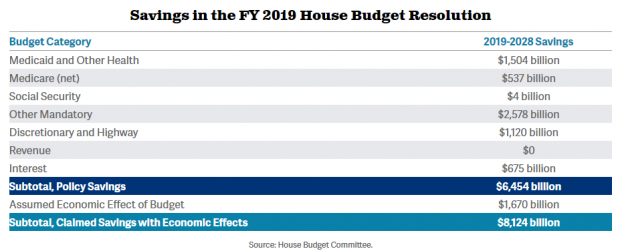

Where savings come from: Most notably, the House budget plan would cut spending on mandatory programs including Medicare and Medicaid by $5.4 trillion over 10 years. The budget aims to eliminate $537 billion in Medicare spending over the next decade. Social Security spending would be reduced by as much as $4 billion by eliminating the ability for enrollees to receive both unemployment benefits and Social Security disability insurance. Roll Call offers this handy breakdown, noting that the plan assumes $1.3 trillion in savings from Obamacare repeal and about $2.5 trillion more from:

- Reducing improper government payments by 50 percent over a decade, saving $745 billion.

- Cuts to welfare and federal retirement programs saving $923 billion.

- Cuts to veterans’ programs intended to save $59 billion.

- Changes to student loan programs, intended to generate $231 billion.

- Changes to agricultural programs, which would save $23 billion.

- Overhauling medical liability lawsuits, assumed to save $33 billion.

And the CRFB sums it all up in chart form:

The safety net: The budget assumes that Congress will fully repeal Obamacare, and it adopts the same approach to Medicaid that House Republicans took last year in their Obamacare repeal effort: It would overhaul Medicaid by introducing per capita spending caps, or optional block grants if states prefer. The budget also envisions the introduction of work requirements for able-bodied, childless Medicaid beneficiaries. The proposed changes to Medicare include gradually raising the eligibility age to 67 and changing the program to give seniors the option of enrolling in private health care plans.

What critics say: Democrats pounced on the proposed cuts. "Democrats will make sure everyone knows that after providing millionaires and corporations with massive tax breaks, House Republicans decided to pay for it by once again calling for a repeal of the Affordable Care Act, ending Medicare as we know it, and offering deep cuts to investments in economic growth," said John Yarmuth of Kentucky, the ranking Democrat on the Budget Committee.

Budget hawks, while praising the basic act of putting forth a budget resolution and cheering the projected deficit reduction, warned about gimmicks in the plan, such as those rosy growth projections, unspecified or unrealistic spending cuts — and a complete lack of accounting for the second round of tax cuts that Republicans want. “Budgets shouldn't exclude one of your party's biggest agenda items,” Tyler Evilsizer of the Committee for a Responsible Federal Budget tweeted.

The lack of detail in the spending cuts drew the ire of Rep. Tom McClintock (R-CA). “Only $300 billion is in the actual reconciliation bill. So the remaining 95 percent of that $5.4 trillion is going to require action by future congresses because we just can’t bear to make those decisions this year,” McClintock said. “The rest is happy thoughts and pixie dust.”

What happens next: The blueprint will be marked up by the Budget Committee for a second day on Thursday and may get approved by the committee this week, but it stands little chance of advancing beyond that. “With Republicans battling to retain their House and Senate majorities, GOP leadership in both chambers might not want to force their vulnerable members to vote for a plan that could open them up to likely Democratic attacks that they’re trying to take away health benefits from the elderly and the poor,” David Sherfinski wrote in The Washington Times.

However, Bloomberg’s Wasson notes that the rescission process still “could be used by lame-duck lawmakers after the election to ram through Republican-only legislation” like another Obamacare repeal bill.