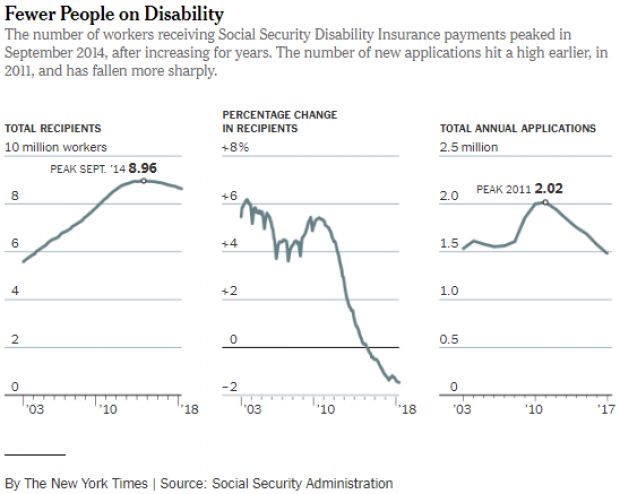

The Social Security trustees’ report released earlier this month estimated that the Federal Disability Insurance Trust Funds will run out of reserves in 2032, four years later than expected. The improved solvency of the trust funds reverses a long process of fiscal decline for the program, which saw a doubling of the disability rolls in the last 25 years.

Applications for disability coverage fell to 1.5 million last year, the lowest level since 2002. Applications “just kept dropping, by a much greater extent than we anticipated,” Stephen C. Goss, the agency’s chief actuary, told Nelson Schwartz of The York Times. “We’re still not done — we should have a little bit more good news in 2018.”

The largely unforeseen reduction in the number of people claiming disability has several causes, says Schwartz. First and foremost, the stronger economy is drawing marginal workers back into the labor force. A booming economy tends to create more low-skill jobs that don’t require manual labor, making it easier for workers with moderate disabilities to find employment.

The expansion of Medicaid in 33 states and the availability of health coverage through the Affordable Act are also likely playing a role by providing alternative ways to obtain health insurance. Basic demographics come into play as well, as millions of baby boomers age into Social Security and Medicare, reducing their need to rely on the disability program.

A final factor: Disability coverage is getting harder to obtain, Schwartz says. Dozens of Social Security field offices have closed since 2010 and judges have been trained to be more skeptical of disability claims as lawmakers crack down on what they see as an overly-permissive system. Critics, however, say the crackdown has gone too far, hurting vulnerable citizens who need help.