The economy grew a little slower in the first quarter of 2018 than previously estimated, the Commerce Department announced Thursday, with the latest estimate for GDP growth coming in at 2 percent, a downward revision from the 2.2 percent estimate produced a month ago.

The growth in corporate profits, on the other hand, was revised higher. “The income side of the growth ledger was boosted by after-tax corporate profits, which surged at an 8.7 percent rate last quarter rather than the 5.9 percent pace reported in May,” Reuters said. The Wall Street Journal suggested that the strong growth in profits “could signal the newly lowered federal corporate tax rate, which was cut to 21% from 35%, and other tax-law changes may have affected businesses’ bottom lines substantially.”

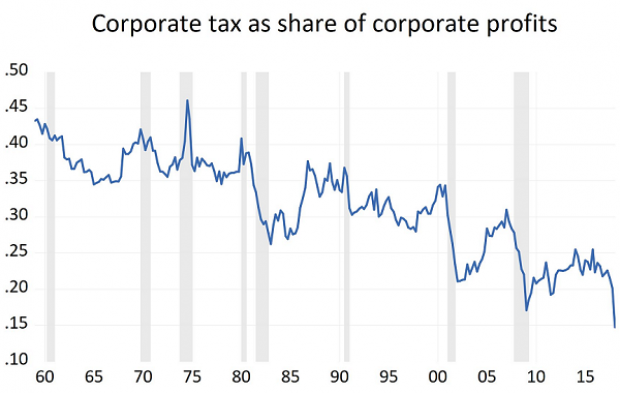

Jared Bernstein, a fellow at the Center on Budget and Policy Priorities and a former economic adviser to Vice President Joe Biden, notes that corporate taxes as a share of profits have fallen to the lowest level since records began in 1947.

The odd thing, Bernstein says, is that the sharp drop in taxes relative to profits is happening during an economic boom rather than during a recession, which is more typically the case (previous sharp drops in the chart above tend to occur in the shaded areas marking recessions). And while the reduction in the corporate tax burden may make wealthy business owners happy, the trend only exacerbates one of the central fiscal challenges facing the country – namely, sustaining Social Security, Medicare and the rest of the social safety net at a time of soaring economic inequality.