As the federal deficit rises, the U.S. Treasury plans to borrow $329 billion between July and the end of September, and another $440 billion in the last three months of the year. If those numbers hold, the Treasury will have increased its borrowing by 63 percent compared to the same six-month period a year ago.

The Treasury’s Borrowing Advisory Committee said this week that the monthly debt sales will continue to rise as the deficit continues to grow over the next several years, according to Josh Zumbrun and Daniel Kruger of The Wall Street Journal.

Yields on Treasury debt have been rising as the borrowing binge picks up speed, with the 10-year note touching 3 percent this week, an increase of three-quarters of a point in a year. The sheer size of U.S. government borrowing is hanging over the bond market, Zumbrun and Kruger write, and many analysts think that increasing rates will lead to higher borrowing costs. Strong demand for relatively safe U.S. debt has kept those costs in check so far, however, although a stronger economy could reduce that demand significantly, sending interest rates higher.

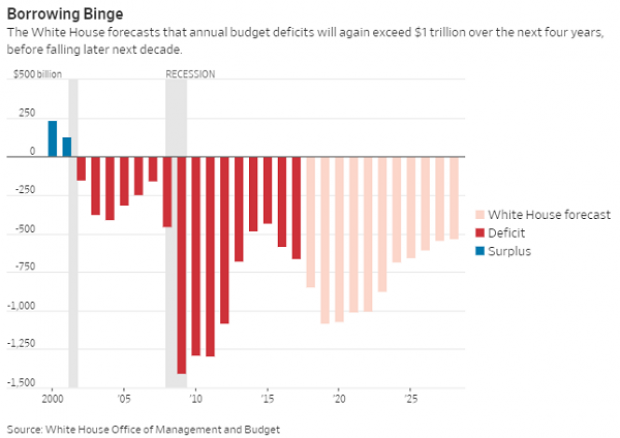

The Office of Management and Budget projects trillion-dollar deficits for the next four years (see the chart below), but most analysts expect that trend – and the related borrowing binge – to continue for much longer. The Journal’s Nick Timiraos pointed out that the White House’s projected decrease in the deficit starting in 2023 relies on two key assumptions:

1) 3 percent economic growth is sustained over many years,

2) Congress makes substantial spending cuts starting in 2024.

If neither of those assumptions hold – and few economists expect them to – we end up with permanent trillion-dollar deficits and a long-term deficit-to-GDP ratio near 5 percent. “Deficits at 5% of GDP have only happened twice in the postwar period,” Timiraos notes, “and both followed periods of 10% unemployment.”

Bernard Baumohl, chief global economist at the Economic Outlook Group, said in a note to clients, "We're applauding strong growth — yet have no choice but to borrow the largest amount of money since the financial crisis a decade ago. And that's just the start, the US will [be] running trillion dollar deficits as far as the eye can see."