The Affordable Care Act provisions preventing insurers from discriminating against patients with pre-existing medical conditions have become a popular — and politically potent — element of the law, and the new Kaiser Family Foundation tracking poll shows why: Six in 10 Americans say that they or someone in their household suffers from a pre-existing condition such as asthma, diabetes or high blood pressure.

It’s no surprise then that the tracking poll also finds that 75 percent of Americans now say that it is “very important” to keep the provision prohibiting insurance companies from denying a person coverage because of his or her medical history. Another 15 percent say it is “somewhat important” this provision stays in place. Similarly, 72 percent say it is “very important” that the provision to keep insurance companies from charging sick people more remains law. Another 19 percent say it is “somewhat important.”

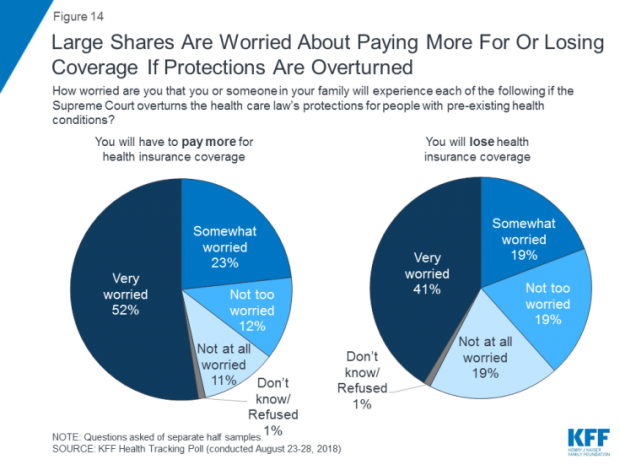

In addition, more than 60 percent of Americans are “very worried” or “somewhat worried” that they will lose insurance coverage if the Supreme Court overturns the Affordable Care Act’s protections for people with pre-existing conditions. And 75 percent are “very worried” or somewhat worried” that they or a family member will have to pay more for coverage.

Democrats have been hammering the administration and Republicans for their willingness to have a court invalidate protections for those with pre-existing conditions.

As part of their effort to push back on that line of attack, 10 Republican senators last month introduced new legislation that they say would prevent insurance companies from denying coverage to people with pre-existing conditions, or charging those people more, no matter what happens in the Texas court case. Critics have said that the GOP bill’s protections don’t go as far as Obamacare’s. Republicans have responded by saying they’d be willing to look at changes to make the legislation more comprehensive.