House Republican leaders said Wednesday that they plan on releasing legislation for a second round of tax cuts next week and voting on it this month.

House Ways and Means Committee Chair Kevin Brady (R-TX) has said that the Tax Cuts 2.0 legislation will likely be broken into a few separate bills centered around making permanent the individual tax changes in last year’s overhaul. Those provisions were made temporary in order to comply with Senate rules that allowed the tax cuts to pass with a simple majority rather than 60 votes.

The cost of making permanent those individual tax cuts, including a 20 percent deduction for passthrough business income, would be an additional $627 billion over the 10-year budget window, according to estimates from Congress’ Joint Committee on Taxation. Extending the individual income tax cuts set to expire after 2025 would cost $522 billion over that time.

But analysts noted that the real long-term costs would be much higher, since the JCT estimates only factor in the cost of the tax cuts for three extra years beyond when they were set to expire. The liberal Center on Budget and Policy Priorities (CBPP) estimated that the individual tax cuts would cost about $2.8 trillion over the first ten years of being permanent (that is, 2026-2035), or about $3.3 trillion over the next 10-year budget window (2029-2038). An analysis published in April by the Penn-Wharton Budget Model found that “extending the individual-side (non-business) tax cuts increases government debt by over $5 trillion by 2040 and actually reduces GDP during the first 10 years and beyond.”

Republicans don’t seem phased by the price tag. Brady told Tax Notes that the JCT estimate, requested and released by Democrats, is consistent with the committee’s planning and called it a “very modest and smart investment in the economy.” House Ways and Means Committee member Carlos Curbelo (R-FL) similarly downplayed the resulting deficit increases. “I don't dismiss this as irrelevant,” he said, according to Tax Notes, “but at the same time I don't think that this bill is going to have a decisive impact on our debt situation.”

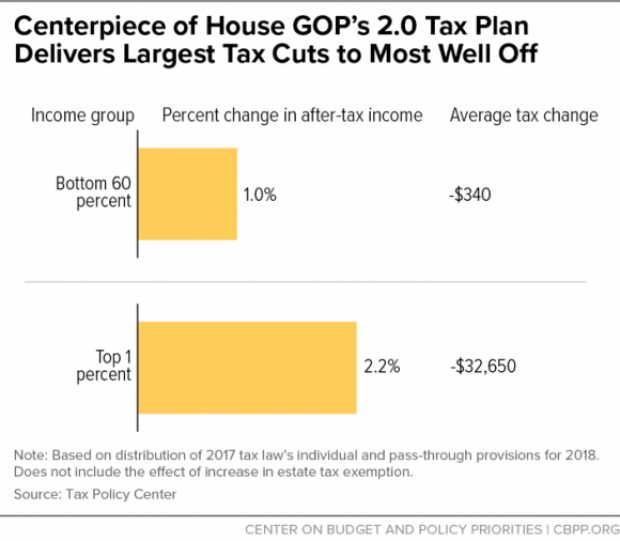

The CBPP report, though, blasted the tax package, saying it “fails the fiscal responsibility test” while “once again delivering substantially more to high-income households than to those with low and moderate incomes.” Authors Chuck Marr and Brendan Duke warn again that low- and middle-income households could wind up worse off over the long run if the tax cuts are made permanent. “The roughly $250 billion permanent annual cost of doing so will have to be paid for at some point, through program cuts and/or tax increases that likely would reduce many low- and middle-income families’ incomes more than the tax cuts increase them.”