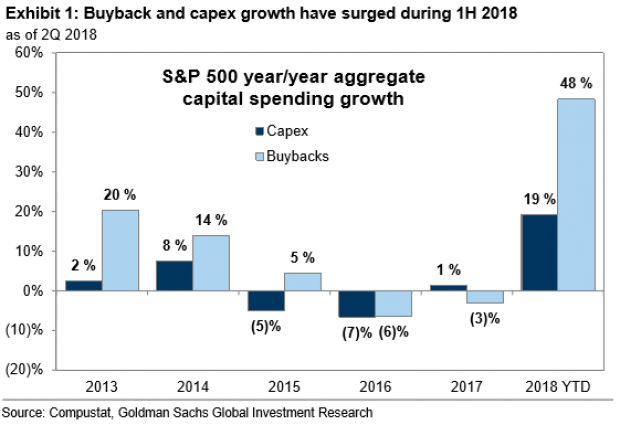

Stock buybacks are now the most popular way for S&P 500 companies to spend their profits, the first time that’s happened in 10 years, Goldman Sachs said in a research note Friday. Buybacks surged 48 percent in the first six months of 2018, hitting $384 billion, up from $259 billion in the first half of 2017. Goldman estimated last month that buybacks could hit $1 trillion this year.

Historically, corporations have spent the biggest chunk of their profits on capital expenditures, Goldman said. While that’s not the case so far this year, business investment is still rising at a rapid pace, hitting $341 billion in the first half, up 19 percent from the $286 billion recorded in the first half of 2017. If the pace continues, it would produce in the best rate of capital investment growth in at least 25 years, Goldman said.

Not all companies are boosting spending on buybacks and investments, however. Buybacks are particularly concentrated among a small number of firms, with just 10 companies accounting for about 78 percent of the activity and one firm alone – Apple – accounting for nearly a quarter. Investment is more spread out, with the top 10 firms in the S&P 500 accounting for a bit more than half of all capital investment.