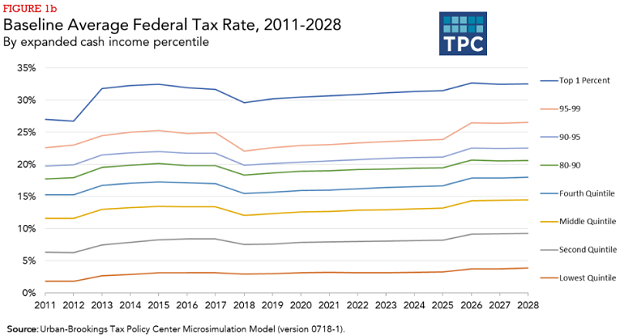

The U.S. tax system has become more progressive in recent years, says Eric Toder of the Tax Policy Center, thanks to real income growth and changes in federal policy. While the tax cuts passed last year interrupted the trend, making the tax code less progressive, the combined effect of continued economic growth and the expiration of the individual tax cuts after 2025 will produce a slightly more progressive tax code by 2028.

Toder defines progressivity as “how much the tax system increases the share of after-tax income received by lower-income households and reduces the share received by upper-income households.”

For example, in 2017, the bottom 20 percent of households in the U.S. received 4.0 percent of pre-tax income, but 4.8 percent of post-tax income – a significant boost created by fiscal policies. Conversely, the top 1 percent’s share of income was reduced from 15.5 percent before taxes to 13.2 percent after taxes, due in large part to higher tax rates on upper incomes.

That redistribution will be less pronounced in 2018 due to the tax cuts. “It should be noted,” Toder writes, “that the US tax system would be even more progressive by 2028 had the [Tax Cuts and Jobs Act] not been enacted.” And if the individual tax cuts are extended after 2025, as many experts expect, the tax code would be less progressive toward the end of the decade.

Here’s a look at how average federal income tax rates have changed since 2011 and where they are headed over the next decade, according to TPC’s new estimates.