With a reduced staff and a shift in focus away from basic fraud, the IRS is pursuing fewer tax evasion cases than it did 10 years ago, according to an analysis released Monday by ProPublica and The New York Times. As a result, “there may never be a better time to be a tax cheat,” say the authors, Jesse Eisinger and Paul Kiel.

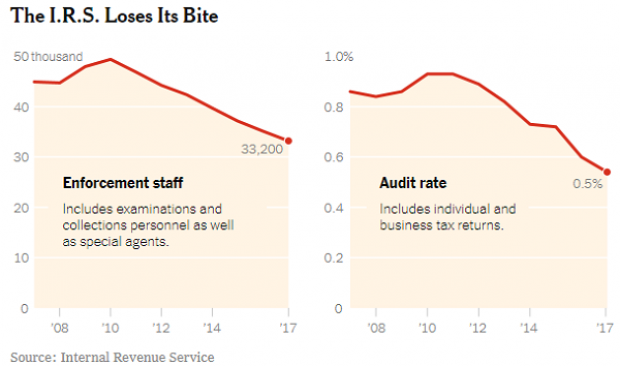

Since 2011, Republican lawmakers have cut the IRS’s budget and reduced its enforcement staff by about a third, and the audit rate has fallen even more sharply.

At the same time, IRS investigators have focused more on drug trafficking and money laundering, with basic tax issues now comprising less than half of all enforcement cases, Eisinger and Kiel found.

One consequence of the budget cuts is that the government is missing out on billions of dollars annually, with estimates of lost tax receipts from businesses alone coming in at $125 billion a year. The lack of enforcement also sends a message to taxpayers that cheating will be ignored for the most part, increasing the size of the tax gap — the difference between what the government is owed and what it receives — now and in the future. The IRS estimated that the tax gap averaged more than $450 billion per year between 2008 and 2010, with most of the lost revenue — about $387 billion a year — due to businesses and individuals underreporting income.

Read the full report at ProPublica.