President Trump, top administration officials and Republican congressional leaders claim that the rising deficit, which grew 17 percent to $779 billion in fiscal 2018, is not the result of their tax cuts.

They’ve acknowledged that they prioritized increased defense spending and said that they would tackle the deficit by targeting spending going forward. But they’ve ignored the effect of the tax cuts — and some other deficit-financed policies — while seeking to lay the blame for rising deficits on everything from natural disasters to Democratic spending priorities to social safety net programs. To wit:

- “Excuse me. No. 1, I had to take care of our military. I had no choice but to do it, and I want to take care of our military. We had to do things that we had to do,” Trump told the Associated Press in an interview Tuesday. “Now we’re going to start bringing numbers down. We also have tremendous numbers with regard to hurricanes and fires and the tremendous forest fires all over. We had very big numbers, unexpectedly big numbers.”

- “People are going to want to say the deficit is because of the tax cuts — that’s not the real story,” Treasury Secretary Steven Mnuchin told CNN last week, arguing that Republicans went along with Democratic demands for increased non-defense spending in order to secure “very, very important” increases in defense outlays.

- Mick Mulvaney, director of the White House Office of Management and Budget, similarly sought to portray the issue as entirely about spending: “America’s booming economy will create increased government revenues — an important step toward long-term fiscal sustainability,” he said in a statement announcing the 2018 numbers. “But this fiscal picture is a blunt warning to Congress of the dire consequences of irresponsible and unnecessary spending. The President’s FY 2019 Budget presented a clear roadmap to solving this fiscal nightmare that has been exacerbated by Congress’s continual unwillingness to restrain spending.”

- Senate Majority Leader Mitch McConnell (R-KY) yesterday told Bloomberg that spending on entitlements was to blame for “very disturbing” growth in the national debt, ignoring the effect of the tax cuts. McConnell had said last year he didn’t think the tax changes would increase the deficit.

How the Tax Cuts Factor In

But Bloomberg reporter Steven Dennis noted in a Twitter thread that “the deficit would be shockingly close to zero today with Clinton-era tax levels.”

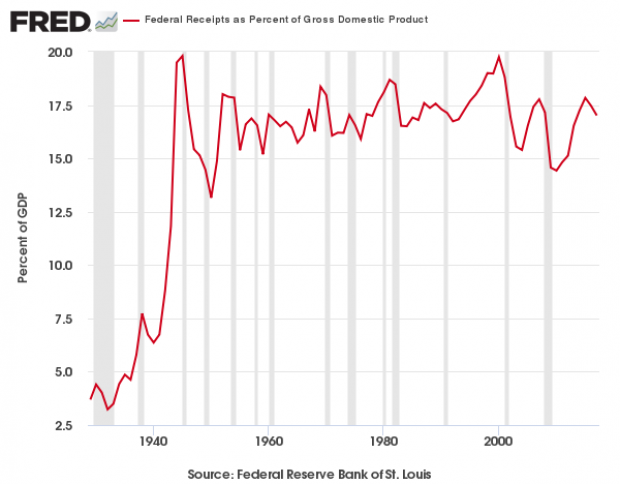

Federal revenue has fallen to 16.5 percent of gross domestic product, he writes. If it was still at roughly 20 percent of GDP (it topped out at 19.75 percent in 2000), the deficit would have been less than $100 billion. Granted, those final years of the Clinton administration coincided with the height of the dotcom bubble, but the broader point remains: The tax cuts of the past two decades are a big part of how the deficit reached $779 billion in 2018.

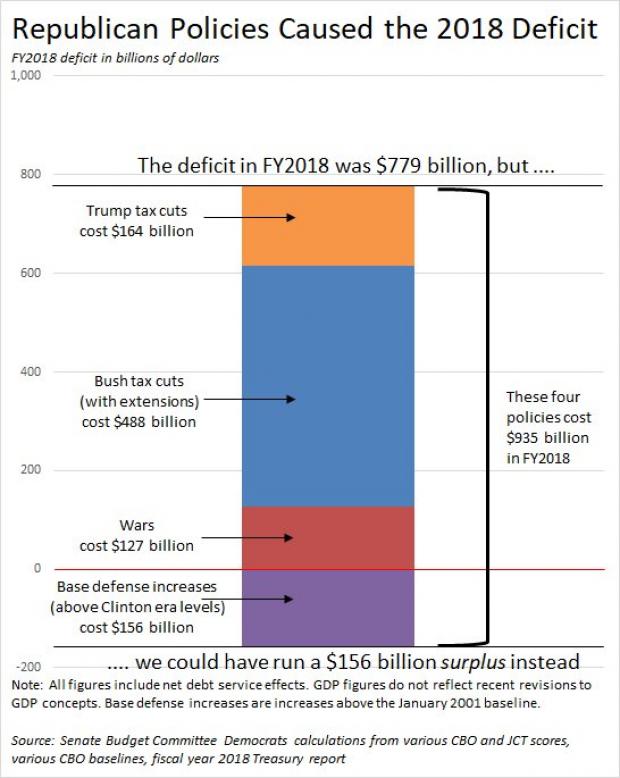

Dennis’ points echo a report issued by Senate Budget Committee Democrats arguing that tax cuts passed under Presidents George W. Bush and Trump “are responsible for over 80% of the deficit” and that, if not for Republican policies more broadly, the government would have posted a surplus in 2018.

Those arguments can and will be debated, and none of that tax talk diminishes the long-term shortfalls faced by Social Security and Medicare.

But if we’re going to have any semblance of a proper national debate on fiscal priorities — including a hard look at spending — we need to understand how we got to this point. Tax policy must be part of that discussion, especially as Republicans still hope to enact a second round of cuts. The truth, thus far at least, is that the tax cuts passed in 2017 have added to the deficit. “There are several ways to ask the question, ‘Are tax cuts paying for themselves?’” Jim Tankersley writes in The New York Times. “Based on the data we have right now, they all arrive at the same answer: ‘No.’”