Sen. Kamala Harris (D-CA) made a splash last week with a tax proposal designed to assist low- and middle-income households – and to provide a strong contrast to the Republican tax cuts that went into effect this year. Harris’ LIFT (Livable Incomes for Families Today) the Middle Class Act would create fully refundable tax credits of up to $6,000 for households earning less than $100,000 a year. On Wednesday, the conservative Tax Foundation released its analysis of the proposal, finding that it would offer considerable economic benefits for such households, though at substantial cost in terms of lost tax revenues.

The Tax Foundation found that:

- Harris’ LIFT credit would reduce federal revenue by $2.7 trillion between 2019 and 2028 before factoring in the projected economic impact of the change. On the economic effects are included, the Tax Foundation says, the proposal would lower federal revenue by $2.8 trillion over that timeframe.

- Harris has proposed paying for the new tax credit by repealing parts of the 2017 Republican tax law that benefit people earning more than $100,000 and by instituting a bank tax of some sort, but the Tax Foundation said those proposals were too vague to be included in its modeling.

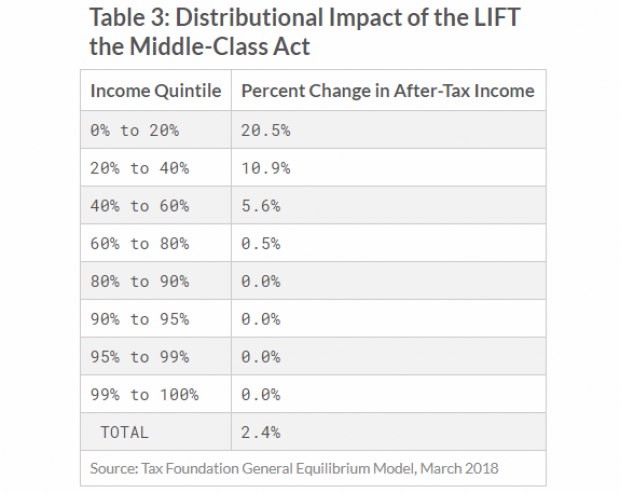

- Harris’ plan would have a significant impact on the after-tax incomes of low- and middle-income households. The bottom 20 percent of earners would get a 20.5 percent boost to after-tax earnings, while those in the next two quintiles (20% to 40% and 40% to 60%) would see increases of 10.9 percent and 5.6 percent, respectively (see the chart below). “The LIFT credit would greatly increase the progressivity of the federal tax code,” the analysis says.

- Over time, the Harris plan would lead to about 826,000 fewer full-time equivalent jobs and a 0.7 percent smaller economy as a result of the tax credit being phased out above certain income levels based on a taxpayer’s marital status and whether they have children. That structure could reduce people’s incentive to work, the Tax Foundation says, an assumption that is built into its economic model.

Harris’ staff called the Tax Foundation analysis "fundamentally flawed" and challenged some of its assumptions. "The notion that receiving a tax credit of up to 500 dollars a month would provide a disincentive for people to work is insulting to every American who shows up to work every day," Harris spokeswoman Lily Adams said in an email to Bloomberg News. “In fact, the bill would substantially increase living standards for millions of Americans, putting money back into their pockets to help them keep up with the rising cost of living."

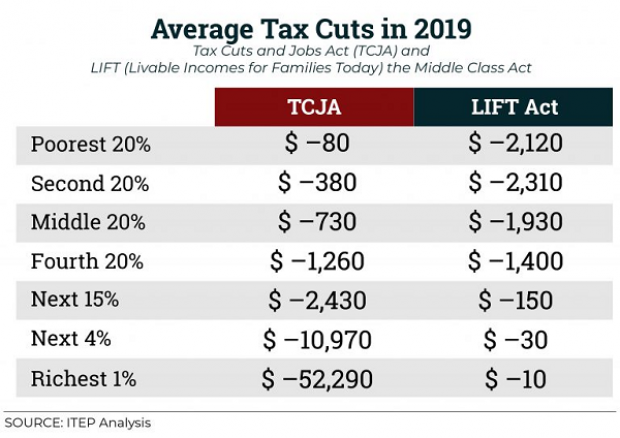

The Tax Foundation’s report puts the cost of the Harris plan in the same ballpark as an analysis done by the liberal-leaning Institute on Taxation and Economic Policy (ITEP), which found that the proposal would cost roughly $250 billion per year. ITEP’s estimates for the size of the average annual tax refunds for various income groups are in the table below, along with the tax benefits produced by the Republican tax cuts that went into effect this year.