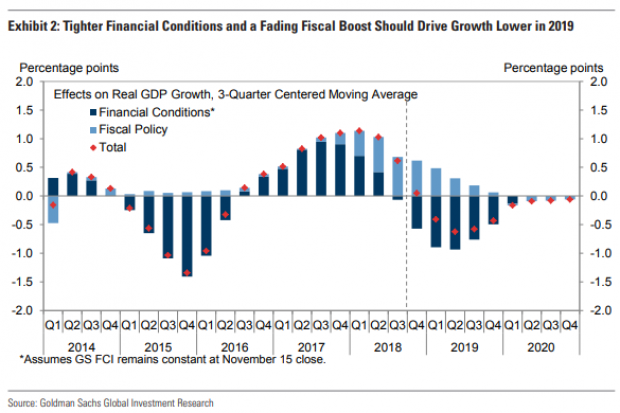

Goldman Sachs is sticking to its forecast of a significant economic slowdown over the next several quarters, driven in part by the waning effects from both the tax cuts and the recent increase in federal spending. "We expect tighter financial conditions and a fading fiscal stimulus to be the key drivers of the deceleration," the bank's chief economist, Jan Hatzius, wrote in a note to clients on Sunday.

Here are some of the key estimates from the Goldman economics team:

- Real GDP growth of 2.9 percent in 2018, 2.5 percent in 2019, 1.6 percent in 2020, and 1.5 percent in 2021.

- Core inflation of 1.9 percent in 2018, rising to 2.2 percent in 2020 and 2021.

- Unemployment rate falling to 3.2 percent in 2019 and 3.1 percent in 2020.

- Five more rate hikes from the Federal Reserve by the end of 2019.

- Ten-year U.S. Treasury yields will likely peak at 3.5 percent in 2019 before falling to 3.3 percent in 2020.

The slowdown isn't projected to lead to a recession, however, Goldman said, since recent economic growth appears to be self-sustaining to some degree. “For now, neither overheating risks nor financial imbalances — the classic causes of US recessions — look worrisome," Hatzius wrote. "As a result, the expansion is on course to become the longest in US history next year, and even in subsequent years recession is not our base case."