The size of your refund check from the IRS doesn’t tell you anything about whether you got a tax cut last year – but it may affect your attitude toward President Trump and his fiscal policies.

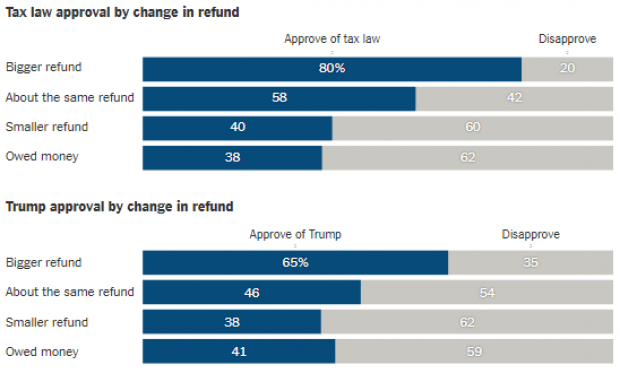

People who have received bigger refunds this year view the Republican tax cuts much more positively than those who have received smaller refunds or owed money, according to poll data analyzed by Ben Casselman and Jim Tankersley of The New York Times. And the same holds true for opinions about Trump himself: bigger tax refunds translate into higher approval ratings for the president. Smaller refunds, however, mean disapproval on both counts.

Millions of people have yet to submit their taxes, so the SurveyMonkey poll – which involved 4,073 respondents who had already filed their taxes – should be seen as a snapshot in time. But the findings nevertheless suggest that tax refunds are playing an important role in how people are evaluating the tax cuts and the president.

Casselman and Tankersley say that the decision by the Trump administration in early 2018 to reduce taxes taken out of paychecks right away could be backfiring. If the Treasury Department had allowed the tax cuts – which most workers benefited from – to show up as larger refund checks, millions more people would likely approve the tax law as they happily cashed their checks from the IRS. But smaller refunds may be having the opposite effect, hurting Trump politically.

Still, the tax season has several more weeks to go and support for the tax law is inching up, possibly because more people are realizing they benefited as they file their taxes. Half of the poll respondents said they approved the law, the highest share in over a year.