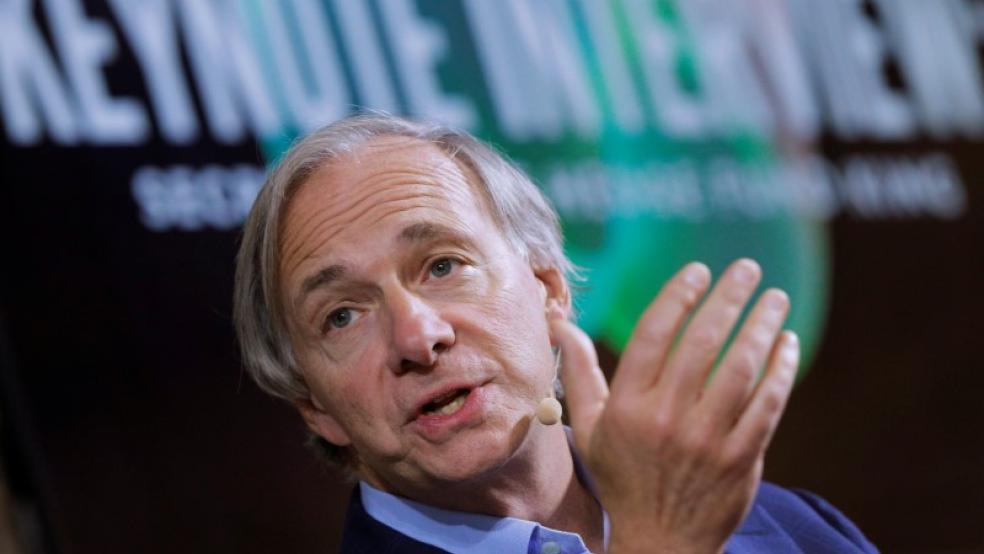

Billionaire Ray Dalio, the founder of hedge fund firm Bridgewater Associates, said Thursday that capitalism isn’t working for most Americans and warned that the growing gap between the haves and have-nots is producing heightened conflict that could lead to revolutionary violence.

Dalio also critiqued both fiscal conservatives and spend-and-borrow liberals, saying that both sides fail to focus on the return on investments that the country needs.

Here are a few quotes from Dalio’s lengthy analysis of the American political and economic system, which he published as a blog post on LinkedIn:

* “I believe that all good things taken to an extreme become self-destructive and everything must evolve or die, and that these principles now apply to capitalism. … the system is producing self-reinforcing spirals up for the haves and down for the have-nots, which are leading to harmful excesses at the top and harmful deprivations at the bottom.”

* “We are now seeing conflicts between populists of the left and populists of the right increasing around the world in much the same way as they did in the 1930s when the income and wealth gaps were comparably large.”

* “It doesn’t take a genius to know that when a system is producing outcomes that are so inconsistent with its goals, it needs to be reformed.”

* "I think that most capitalists don’t know how to divide the economic pie well and most socialists don’t know how to grow it well, yet we are now at a juncture in which either a) people of different ideological inclinations will work together to skillfully re-engineer the system so that the pie is both divided and grown well or b) we will have great conflict and some form of revolution that will hurt most everyone and will shrink the pie."

* “Policy makers pay too much attention to budgets relative to returns on investments. For example, not spending money on educating our children well might be good from a budget perspective, but it’s really stupid from an investment perspective. Looking at the funding through a budget lens doesn’t lead one to take into consideration the all-in economic picture—e.g., it doesn’t take into consideration the all-in costs to the society of having poorly educated people. While focusing on the budget is what fiscal conservatives typically do, fiscal liberals have typically shown themselves to borrow too much money and fail to spend it wisely to produce the economic returns that are required to service the debts they have taken on, so they often end up with debt crises. The budget hawk conservatives and the pro-spending/borrowing liberals have trouble focusing on, working together for, and achieving good ‘double bottom line’ return on investments (i.e., investments that produce both good social returns and good economic returns).”