Happy Tax Day! You’ve probably already filed your return for 2018, or at least most taxpayers have. The IRS says that it received more than 103 million returns by April 5 — and issued nearly 78 million tax refunds totaling $220.8 billion, or $2,833 on average. That leaves about 50 million taxpayers yet to file, though the agency expected about 15 million additional returns to come in over the week ending last Friday — and about 14.6 million extension requests this tax season.

If you’re one of the procrastinators, stop reading this and go take care of your taxes. We’ll wait.

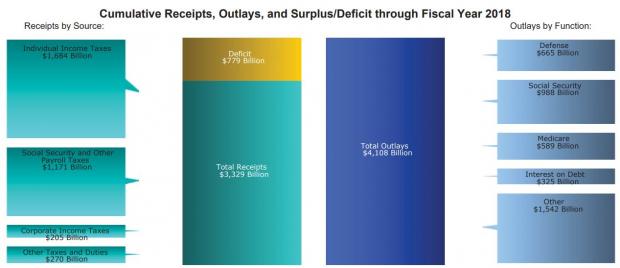

For the rest of us, today is a good day to consider how the government spends our money. Here’s a big picture overview from the Treasury Department of the federal government’s revenues and outlays for fiscal year 2018:

You can see that the Treasury took in about $3.3 trillion in receipts, including $1.7 trillion in individual income taxes, nearly $1.2 trillion in Social Security and other payroll taxes. It spent $988 billion on Social Security, $665 billion on defense, $589 billion on Medicare and $325 on interest payments. The deficit — the gap between what the government spent and what it took in — totaled $779 billion.

In a new piece for Economics 21, Brian Riedl of the conservative Manhattan Institute breaks down federal spending for 2019. The government will spend an average of $35,148 per household, he writes, while collecting $26,677 per household in taxes. The resulting deficit works out to nearly $8,500 per household.

“Federal spending has soared nearly $7,000 per household since 2007 and is projected to rise another $7,000 over the next decade (all numbers in this article are adjusted for inflation),” Riedl says. “Unless spending is reined in, tax increases must eventually result.”

Based on national averages, the more than $35,000 per household in federal spending for 2019 would include:

- $13,178 on Social Security and Medicare

- $6,483 on anti-poverty programs

- $5,312 on defense

- $3,054 on interest on the national debt

- $1,556 on veterans’ benefits

- $1,154 on federal employee retirement benefits

- $876 on education

- $557 on justice administration

- $533 on health research and regulation

- $493 on highways and mass transit

- $422 on international affairs, including foreign aid, U.S. embassies and contributions to the United Nations and other organizations

- $1,530 on all other federal programs, “including natural resources and the environment, disaster aid, unemployment benefits, economic development, farm subsidies, social services, space exploration, air transportation, and energy.”

Read Riedl’s piece for more details on each category of spending.

Update, 4/19/2019: Reader Bruce Munshower of Glastonbury, Connecticut, emailed us to ask for some clarification on the $26,677 in taxes per household Riedl said the government would collect in 2019. That figure multiplied by the number of tax filers we mentioned equals far more than the $1.7 trillion in individual income taxes the government received in fiscal 2018. Why the discrepancy?

The short answer is that Riedl’s $26,677 figure includes all taxes, not just individual income taxes. We reached out to Riedl and are sharing his more detailed response here for Bruce and any other readers who found the numbers perplexing:

“To answer the reader: The op-ed calculates total federal taxes paid per-household - not income taxes paid per tax return. Census Bureau data suggests there are 128.86 million households in 2019. The data includes all federal taxes - income, payroll, excise, estate, even corporate taxes passed on to families. After all, basic tax incidence analysis shows that all federal taxes (even corporate) are eventually passed on to families.”