The Republican tax cuts passed in 2017 have had only a modest effect on economic growth, wages and business investment, according to a new report from the Congressional Research Service.

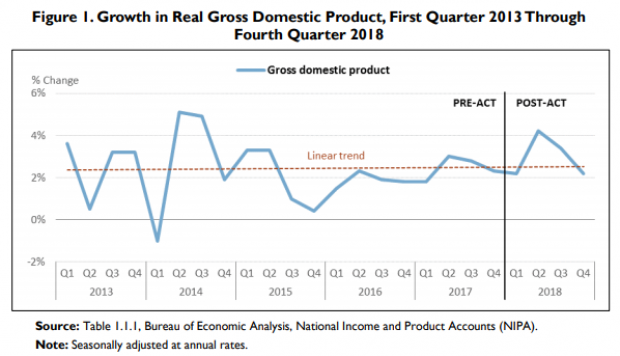

The CRS, a nonpartisan agency within the Library of Congress that has been described as a public policy think tank for lawmakers, found that economic growth in the wake of the tax package has basically followed the existing trend line. “In previous years, output grew by 2.9% in 2015 and 2.5% in 2014, thus the increase in growth is in line with the trend in growth over the period,” the report says.

While there was an increase in the growth rate in the second quarter of 2018 (see the chart below), the jump appears to have been part of a transitory surge that was also driven by a significant increase in federal spending. “On the whole, the growth effects tend to show a relatively small (if any) first-year effect on the economy” from the tax cuts, the report says, adding that “it does tend to rule out very large effects in the near term.”

Some additional takeaways from the report:

* The tax cuts aren’t paying for themselves: The White House insists that the cuts are already paying for themselves, but the CRS report finds no evidence that this is the case. The tax cuts would need to produce a 6.7% increase in GDP in order pay for themselves, but the analysts found a growth effect of about 0.3% — in other words, “5% or less of the growth needed to fully offset the revenue loss” from the tax cuts.

* The tax cuts had their greatest effect on corporations: Individuals saw modest tax cuts, but U.S. businesses experienced substantial — and lasting — reductions in tax rates. “From 2017 to 2018, the estimated average corporate tax rate fell from 23.4% to 12.1% and individual income taxes as a percentage of personal income fell slightly from 9.6% to 9.2%.”

* No surge in investment from abroad: The tax overhaul forced multinationals to bring billions of dollars back to the U.S. and there was a surge in repatriations in the first half of 2018. But as many critics have argued, much of that money is simply being moved around on paper, with little effect on domestic investment. The report finds a small increase (about 0.8%) in private investment last year, but nothing that indicates a change in the long-term trend.

* Wage growth has been lackluster: Nearly 10 years into the recovery, economists expect to see wage growth, but the tax cuts don’t seem to have produced anything outside the existing trend line, which is relatively weak. “The nominal growth rate in wages was 3.2%, but adjusting for the GDP price deflator, real wages increased by 1.2%,” the report says. “This growth is smaller than overall growth in labor compensation and indicates that ordinary workers had very little growth in wage rates.”

* And workers haven’t gotten much by way of bonuses: There was a lot of talk about big bonuses for workers in the early days of the tax cuts, but CRS says the roughly $4.4 billion in reported bonuses come to about $28 per worker. It’s not easy to be sure the bonuses that were paid were actually connected to the tax cuts, either, since they “could also be a result of a tight labor market and attributed to the tax cut as a public relations move,” the report notes.

The bottom line: President Trump claimed that the GOP tax cuts would provide “rocket fuel” for the economy, but so far they have done little to change the long-run trajectory of economic growth.