A major attitude shift has washed over Washington, The Wall Street Journal’s Kate Davidson and Jon Hilsenrath wrote Thursday: “Political support for taming federal debt has melted away.”

Not so long ago, there was widespread agreement in both parties that deficit spending was problematic and the debt was a problem to be solved. But that consensus has all but disappeared in recent years, with Republicans voting for deficit-boosting tax cuts and Democrats pushing large, expensive social programs such as Medicare for All, with little regard for the long-term costs.

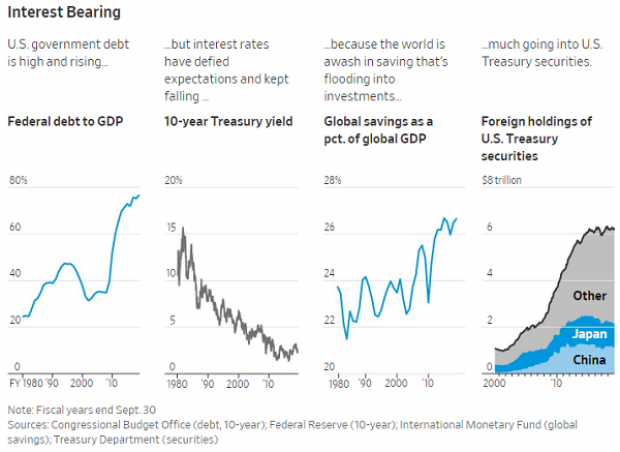

One reason for the shift, Davidson and Hilsenrath said, is that reality has failed to match the dire predictions of the deficit hawks, who warned of economic calamity from soaring debt. Interest rates, which were expected to rise as the U.S. Treasury flooded the markets with new debt, have fallen, and investors are now more concerned about a glut of capital than a shortage of it (see the chart below). On top of that, the economy has remained strong despite the growing deficits, which will soon reach $1 trillion a year.

The lack of a clear connection between growing deficits and economic performance has prompted some economists to rethink these fiscal issues. Olivier Blanchard, the former chief economist at the IMF, said earlier this year that in his view, debt is not necessarily a problem, and in some situations can be deployed with little or no cost. “If you have good uses for it, use it,” Blanchard said.

The public, too, seems to be less interested in the issue than it was in the past, Davidson said. House Budget Committee chairman John Yarmuth (D-KY) said his constituents seem to think, “There haven’t been any cataclysmic consequences, so why worry about it?”

One deficit hawk who’s sticking to his guns, Bill Hoagland of the Bipartisan Policy Center, told the Journal that the general lack of interest in the debt has made him think about “going back to the farm and forgetting all about it,” adding, “It’s almost like I’ve wasted my, whatever it’s been, 45 years in this town.”

Still, some economists warn that the soaring U.S. debt could impose high costs somewhere down the line, even if they don’t seem to be causing much harm now. According to the Journal, Moody’s estimates that interest payments will claim more than 20% of federal revenue within 10 years – a bigger bite than the U.S. saw even in the 1980s and 1990s, when the deficit became a central concern in Washington.