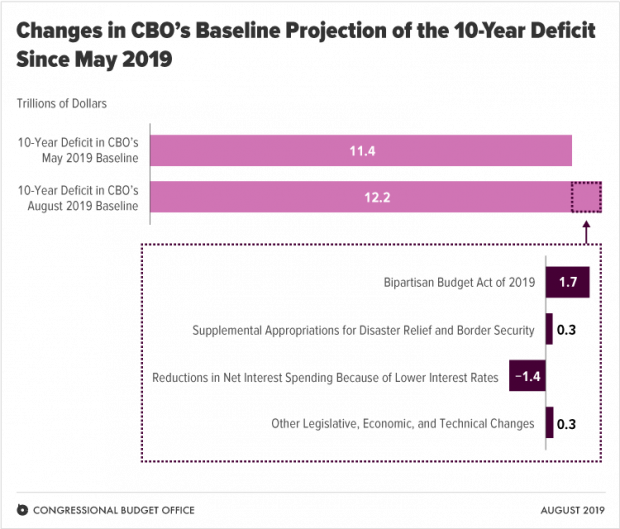

U.S. budget deficits are projected to grow by $809 billion more than previously expected over the next 10 years, primarily as a result of the two-year budget deal passed by Congress last month, the Congressional Budget Office estimated Wednesday.

As a result, the deficit is projected to top $1 trillion by next year, two years sooner than previously estimated. The annual deficit is expected to average $1.2 trillion a year between 2020 and 2029, or about 4.7% of gross domestic product, compared to the 4.3% average CBO projected in May and the 2.9% average over the past half century. And federal debt held by the public is expected to climb from 79% of GDP this year to reach 95% in 2029, three percentage points higher than projected in May, before the budget agreement.

“The nation’s fiscal outlook is challenging,” CBO Director Phillip Swagel said. “To put it on a sustainable course, lawmakers will have to make significant changes to tax and spending policies—making revenues larger than they would be under current law, reducing spending below projected amounts, or adopting some combination of those approaches.”

Spending on the rise: The deal reached by Congress and signed by President Trump raises discretionary spending by $320 billion over the next two years and ends an era of spending caps imposed under a 2011 law. Without those caps in place for 2021 and beyond, the CBO projections are required to assume that discretionary spending will continue to rise with inflation through the rest of the 10-year period covered by its estimates. The result is that the two-year budget deal costs $1.7 trillion over a decade, including $200 billion in additional interest costs. An emergency spending bill providing funding for disaster relief and border security this year adds another $255 billion to the 10-year total.

Revenues fail to keep pace: As The Washington Post’s Jeff Stein points out, CBO projected a few years ago that revenue would be roughly 18% of GDP in 2018 and 2019. Instead, even as the economy has grown, that figure is down to 16.5% in the wake of the GOP tax cuts passed in 2017.

Lower interest costs: The spending increases will be partially offset by changes CBO made to its economic forecast, including lower interest rates, that reduce previously projected costs by $1.1 trillion over the next decade.

The cost of Trump’s trade war: The CBO also said that higher trade barriers — including President Trump’s higher tariffs — are expected to put a small dent in the U.S. economy, making it about 0.3% smaller than it otherwise would have been by 2020.

Why it matters: The CBO report just confirms the budgetary impact of the spending deal. “The recent budget deal was a budget buster, and now we have further proof,” said Maya MacGuineas, president of the Committee for a Responsible Federal Budget. “Both parties took an already unsustainable situation and made it much worse.” At the same time, with fears of an economic downturn intensifying, the new report “is likely to intensify concerns that the United States does not have enough fiscal space to stimulate the new economy to avoid a recession,” The Washington Post’s Stein says.