High levels of government debt spur governments to rein in health care costs, according to a new report from economists at Goldman Sachs. And efforts to reduce health care inflation may help explain why overall inflation rates have been lower than expected in recent years.

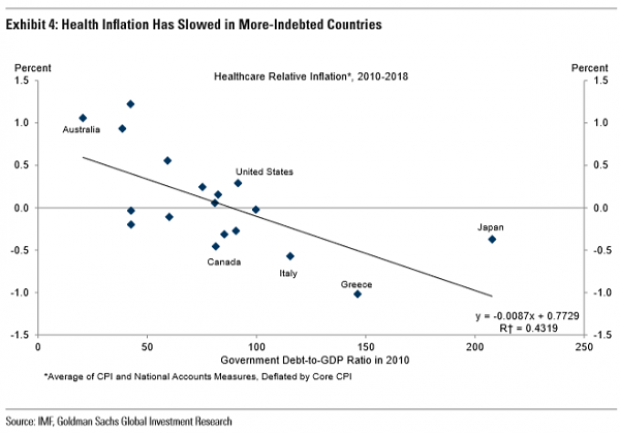

The drive to cut health care costs: Analyzing cost trends, the economists found that the health care sector produced lower rates of inflation — referred to as disinflation — in most industrialized economies over the last decade. Government played an important role in the disinflation story, as increasing fiscal pressure from rising debt levels prompted governments to reduce spending on health care by limiting consumption or shifting costs onto consumers and providers. Although the inflation effects of different policies varied, “tighter fiscal constraints are an important factor behind the downtrend in healthcare inflation,” the report says, with fiscal pressures explaining nearly half of the variation in health care inflation rates.

The U.S. has seen this process play out several times, the authors say. For example, in the 1980s, fearing unsustainable increases in health care costs, Congress reformed the payment systems for Medicare and Medicaid, reducing inflation. More recently, the Affordable Care Act sought to “bend the cost curve” in health care through cost-saving provisions that reduced the inflation rate in the sector.

Australia provides an interesting counter example, the authors say. “Australia has not faced large increases in its national debt, and fiscal pressures have not been as important a factor in healthcare policy,” the economists write. “Indeed, the 25-year long expansion in that country may have reduced pressure to restrain healthcare cost inflation—at least relative to the rest of the world.” (See the chart below demonstrating the relationship between debt levels and health care inflation rates for select advanced economies.)

Inflation may be stronger than it appears: When it comes to the economy overall, the economists question the widely held view that inflation has been markedly weaker over the last decade. While the overall inflation numbers have been a bit lower than expected, the authors say the numbers have been driven largely by the health care and communications sectors. Leaving those sectors aside, the economists see little evidence of core goods disinflation. “US inflation across cyclically sensitive categories has nearly returned to its pre-crisis trend (2.8% in July vs. 3.0% average in 1997-2007),” they write.

Higher health care prices coming up: Looking ahead, the Goldman economists say that the recent period of disinflation in U.S. health care costs is likely coming to an end, for two reasons. First, government spending on health care as a share of nominal output appears to have stabilized at about 8.5%, eliminating some pressure to cut costs. Second, lower interest rates are reducing fiscal pressures by making it easier to cover the cost of increasing debt. “[S]ecularly lower interest rates in the US and globally are likely to ease these downward pressures … because governments find themselves better positioned to finance a given debt load and annual healthcare outlay,” the report says.