Two Democratic lawmakers unveiled a plan Thursday that would raise taxes on high-income households.

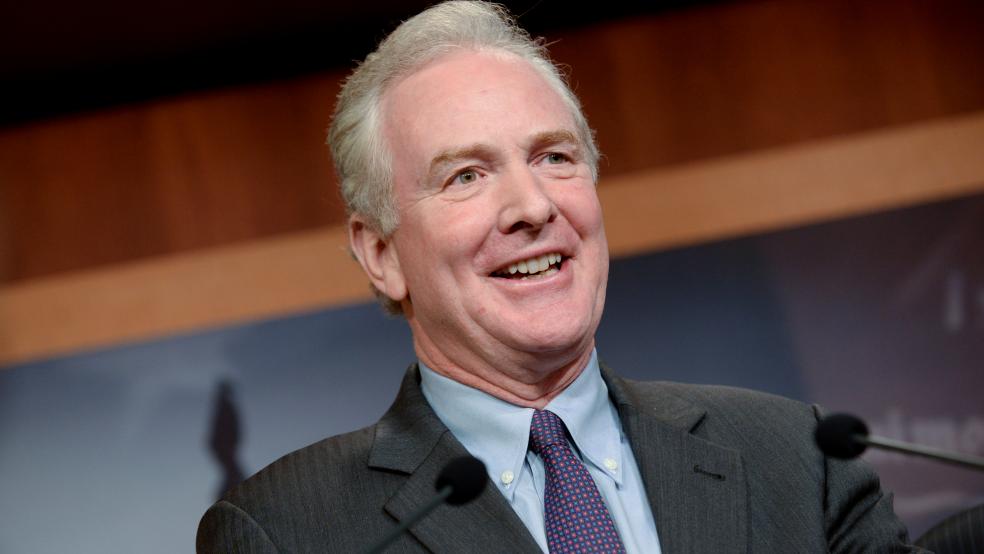

Sen. Chris Van Hollen of Maryland and Rep. Don Beyer of Virginia are proposing a 10-percentage point surtax that would apply to wages and capital gains over $2 million for married couples and $1 million for individuals. That would increase the top income tax rate for those households from 37% to 47% and lift the capital gains rate from 20% to 30%.

Targeting two related problems: “This is a bill designed to address two major problems of public policy: the lack of revenue, and inequality,” Beyer said on a call with reporters. “It’s a laser-focused solution that requires those who benefited the most from the economy to contribute in a way they simply haven’t been asked to before.” Both problems were exacerbated by the GOP’s tax cuts in 2017, the lawmakers said, and the new tax is intended to reverse some of those effects.

Maximizing revenues: The surtax would raise about $635 billion over 10 years while affecting 0.2% of taxpayers (about 329,000 tax paying units in 2020), according to an analysis by the Tax Policy Center. Van Hollen told reporters that the revenue-maximizing tax rate on capital gains tops out somewhere around 33%, according to the Joint Committee on Taxation, and the proposal is designed to hit that money-raising “sweet spot.”

Keeping it simple: Unlike the wealth taxes proposed by Elizabeth Warren and Bernie Sanders, the proposed surtax would be easy to implement, and there are no questions about its legality. (Surtaxes have been used before, including the 3.8% surtax on net investment income that is currently in effect to help cover the cost of Obamacare.) It may also be easier to convince wealthy critics of the Warren and Sanders proposals — some of whom have said publicly that they agree they should be paying more in taxes, even though they oppose the idea of a wealth tax — to adopt it. And it may appeal to moderates, as well.

A broad effort: The legislative proposal is backed by a “millionaires’ surtax” campaign run by several progressive groups, including Americans for Tax Fairness, the Institute for Policy Studies and Patriotic Millionaires. The announcement of the new tax plan was accompanied by a graphics-heavy website and a video that explains the proposal in simple terms.

Polling shows support: A Hart Research poll of 1,001 likely voters commissioned by the surtax group suggests that Americans generally favor raising taxes on the rich, with 65% saying they support higher taxes on the wealthy and on corporations. Democrats overwhelmingly (73%) support the surtax proposal — and a majority of Trump voters (57%) and Republicans (53%) do, too.

The Millionaire’s Surtax group said the poll points to what they see as a winning message on the issue: “it raises more than $600 billion in revenue; it’s paid only by a small fraction of the richest 1%; and it will fund investments that benefit everyday Americans, like education, infrastructure, and healthcare.”