Joe Biden’s tax proposals would generate about $4 trillion in new revenue over 10 years, with high-income households paying the lion’s share of the increase, according to a new analysis by the nonpartisan Tax Policy Center.

TPC’s revenue projection is higher than the Biden campaign's own estimate of $3.2 trillion over a decade, and even more so than the Penn Wharton Budget Model’s estimate of $2.3 trillion.

No matter which estimate is used, it’s clear that Biden’s plan is far more aggressive than those offered by Democrats in past presidential elections and shows just how far the party has moved on the subject of taxes since President Trump signed a $1.9 trillion tax cut into law in 2017.

What Biden proposes:

- Increase the corporate tax rate to 28%, up from the 21% imposed by the 2017 tax law. This would raise an estimated $1.3 trillion over 10 years.

- Apply the Social Security payroll tax to incomes over $400,000, raising an estimated $962 billion.

- Raise the tax rate on capital gains and dividends for households earning more than $1 million per year. Along with a tax on unrealized capital gains of more than $100,000 at death (excluding money bequeathed to surviving spouses and charities), this would raise an estimated $448 billion.

- Roll back the 2017 tax cuts for households earning more than $400,000 per year, raising an estimated $432 billion.

- Double the minimum tax on overseas profits, from 10.5% to 21%.

Who would pay more:

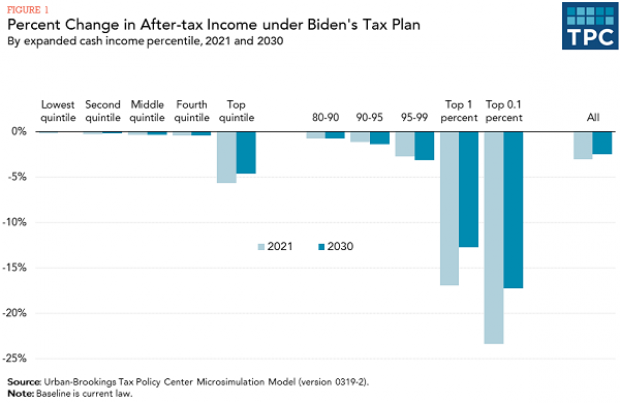

- The top 1% of households would pay 74% of the increased taxes.

- More broadly, the top 20% of households — those making more than $170,000 per year — would pay 93% of increased taxes.

- Income taxes on the top 1% of earners would increase by 17%, or an average of $299,000 per year.

- The very wealthiest taxpayers — the top 10th of the top 1% — would see their tax bills increase by an average of $1.8 million.

- Individuals would account for about $2 trillion of the tax increase, with the other $2 trillion coming from higher taxes on businesses.

Who would pay about the same:

- The bottom 80% of earners would see tax hikes of no more than 0.5%, mostly caused by businesses shifting their tax increases onto shareholders and workers.

Where the money would go: While the TPC analysis did not look at Biden’s spending proposals, the former vice president has called for increased Social Security benefits and an expansion of the public health care system, and he has proposed tax credits for a variety of issues, including family caregiving, electric vehicle purchases and student loan forgiveness.