House Speaker Nancy Pelosi has floated another suggestion for the next round of fiscal stimulus: A retroactive rollback of the 2017 Republican tax law’s limit on state and local tax deductions.

In an interview with The New York Times, Pelosi said that a stimulus plan should do more to get money directly to individuals and suggested that a rollback of the $10,000-a-year deduction limit would be one way to do that. The Democratic-controlled House voted last year to repeal the cap, which has predominantly hurt top-earning households in high-tax blue states such as New York, Illinois and California, but the effort went nowhere in the Republican-led Senate.

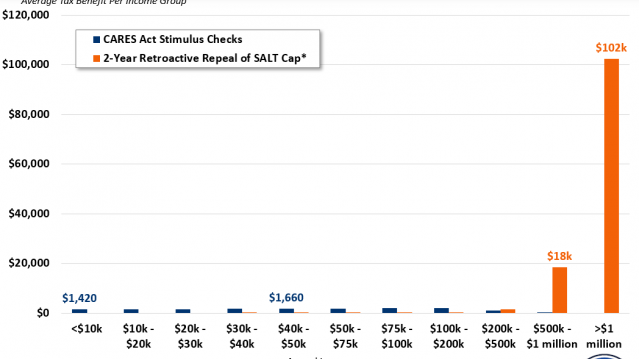

“A full rollback of the limit on the state and local tax deduction, or SALT, would provide a quick cash infusion in the form of increased tax rebates to an estimated 13 million American households — nearly all of which earn at least $100,000 a year,” the Times’s Jim Tankersley and Emily Cochrane explain.

A Pelosi spokesman tweeted Monday night that “action on SALT would be tailored to focus the benefits on middle class earners and include limitations on the high-end.” But it could be difficult to have any rollback benefit significant portions of the middle class.

As Tankersley and Cochrane note, the congressional Joint Committee on Taxation estimated last year that a repeal of the SALT limit for 2019 would have cut federal revenues by about $77 billion, with $40 billion of that going to taxpayers earning $1 million or more and most of the rest benefiting households with incomes of $200,00 or more. The Tax Policy Center estimates that only 3% of households in the middle quintile of American taxpayers would receive any benefit from the SALT cap repeal.

Republicans dismissed Pelosi’s proposal as part of a partisan wish list. Tax experts and budget wonks, meanwhile, reacted with horror:

- “Nooooooooooooooooo,” tweeted Nicole Kaeding, an economist with the National Taxpayers Union Foundation.

- “It certainly gets money into hands. But I’m not sure it’s the correct hands,” Kyle Pomerleau, a resident fellow at the conservative American Enterprise Institute, told the Times.

- “Weakening or eliminating the SALT cap would be regressive, expensive, poorly targeted, and precisely the kind of political giveaway that compromises the credibility of emergency spending,” Maya MacGuineas, president of the Committee for a Responsible Federal Budget, said in a statement. “As stimulus or economic relief goes, I’m not sure one could design a less targeted policy.”

- “[T] here are about 1,000 better ways to get help to middle-income people right now,” Michael Linden, a liberal wonk who is executive director of the Groundwork Collaborative, tweeted. “This is a road not worth going down.”