Lucy Dadayan of the Urban-Brookings Tax Policy Center breaks down the good, the bad and the ugly of the fiscal crisis facing states as the coronavirus pandemic crushes revenues and raises costs.

“Prior to the onset of the COVID-19 pandemic, most states were generating solid revenue growth. And many built up robust rainy day funds. But the pandemic has largely wiped out earlier revenue gains and most states now anticipate substantial revenue shortfalls for the current fiscal year and for fiscal year 2021,” she writes.

The good: Preliminary April tax revenue data show a steep drop in estimated and final annual tax payments as the tax-filing deadline got pushed back from April 15 to July 15. But taxes withheld from paychecks grew in 17 states compared to April 2019. “Tax withholding is usually a better indicator of the current strength of the economy and of the path for personal income tax revenue because it comes largely from current wages,” Dadayen explains. On the other hand, 16 states reported declines of less than 10%, while five states posted double-digits drops, so the bright spots are limited.

The bad: “Declines in sales tax revenues have been fast, steep, and widespread across the states,” Dadayen writes. How steep? April sales tax revenues fell by 16% across 42 states for which the Tax Policy Center has complete data. Twenty-three states reported double-digit declines, while just five states reported year-over-year growth. And since the April data mostly reflect March sales, the May numbers are likely to be even worse.

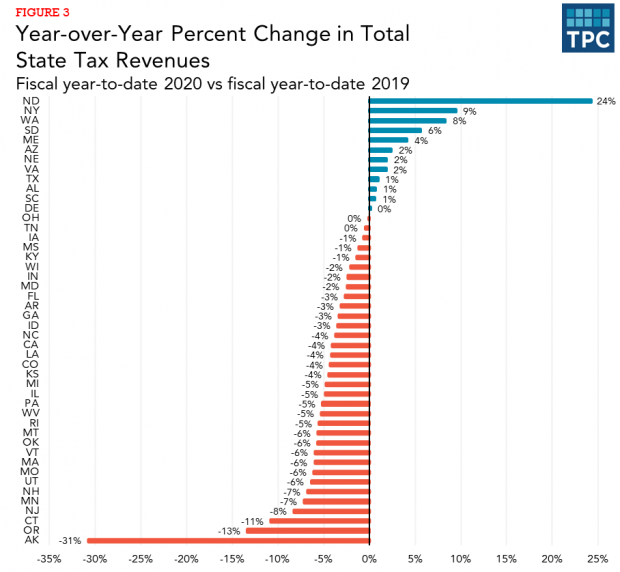

The ugly: For the fiscal year so far, total state tax revenue has fallen sharply — and next year is expected to be worse. “With two months remaining in the fiscal year for 46 states, total state tax revenues are now down about $57 billion, compared to last year,” Dadayen writes.

After the sharp pandemic-related plunge in April, tax revenues have fallen in 34 states compared to 2019 and risen in 12. (New York, the state hit hardest by the virus, is surprisingly among those dozen, but Dadayen says that’s only because its fiscal year 2020 ended in March, so April’s devastation isn’t reflected in the data. The state reported that net taxes and fees collected in April, the first month of its new fiscal year, fell by 69% compared with April 2019.)