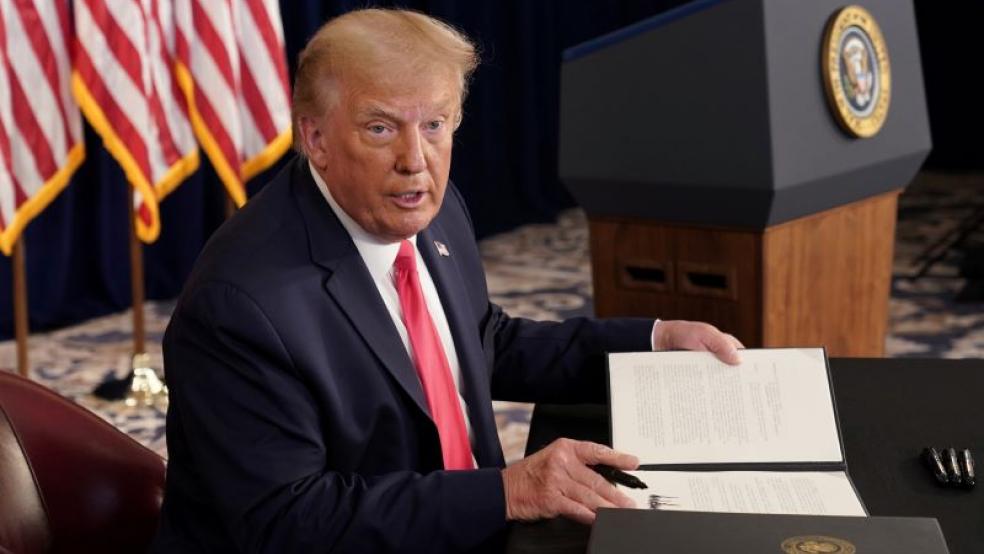

President Trump said the series of executive orders he signed on Saturday were intended to bypass stalled negotiations in Congress and deliver some economic relief to millions of Americans hurt by the coronavirus recession. Trump said the orders — which he called bills, a term for legislation considered by Congress — “will take care of, pretty much, this entire situation.”

That's clearly not the case. For one thing, one or more of the orders — a new federal unemployment benefit, a temporary deferral of payroll taxes, an eviction moratorium and student loan relief — could still face legal challenges. House Speaker Nancy Pelosi (D-CA) called them “absurdly unconstitutional,” though she and Senate Minority Leader Chuck Schumer (D-NY) both stopped short of saying whether they would sue to block them.

Even leaving potential legal challenges aside, the effects of Trump’s actions were not as straightforward as the president made them out to be, casting doubt as to how much relief they might ultimately provide. CNN reports that “a close read of the actual text of executive actions [the president] signed Saturday suggests that even if they are deemed constitutional, they will not quickly deliver the aid Trump promised. They may not deliver much at all.”

Far less questionable is that the president’s unilateral actions — not bills, but three memoranda and an executive order — collectively represent another Trump administration challenge to the constitutional tax and spending powers of Congress. Experts also warn that one of the actions, a deferral of payroll tax collection, could threaten funding for Social Security and Medicare, exacerbating the long-term cash shortfalls the programs already face.

Here’s a breakdown of the executive actions and what they really mean.

Unemployment benefits: The Trump memorandum would provide $400 in enhanced unemployment benefits to eligible workers, down from the $600 provided by the CARES Act passed in March. The Trump plan also has strings attached that could limit the number of people who get the benefit. Unemployed workers must receive at least $100 a week in other unemployment benefits in order to qualify for the $300 federal benefit, potentially leaving many low-income workers ineligible for the federal assistance. And states, many already financially strapped, must agree to cover 25% of the cost, or $100 per payment.

Trump said that states would be able to cover their costs by using money provided under the CARES Act or other state funding, but some states may not be able to afford the additional cost. States that don’t enter into the agreement with the federal government or don’t have the funds to cover their share of the payments would see the unemployed get no extra federal benefit. Treasury Secretary Steven Mnuchin suggested on “Fox News Sunday” that the president would be willing to waive the 25% contribution from states.

States will also have to set up new systems to deliver aid under Trump’s plan, which reportedly could take months. “This is a brand new program, it's an assistance program for lost wages, it requires the creation of an entirely new administrative system. The states that don't get the program set up as quickly as other states aren't going to get any funding because it will run out,” Michelle Evermore, an unemployment expert at the National Employment Law Project, told CNN.

Federal funding for the program is also a question. Trump said he would use $44 billion allocated for disaster relief, but economists cited by The Washington Post project that would only cover some five weeks of payments based on current unemployment levels.

Payroll tax deferral: Trump ordered collection of the employee portion of payroll taxes — 6.2% for Social Security — to be deferred from September through the end of the year for Americans earning less than $104,000 annually. That means workers could eventually get hit with a big tax bill. As a result, and given the complexities involved, employers may continue to withhold the money to cover the taxes when they’re due.

Trump pledged Saturday to forgive the taxes and make the cuts permanent if he wins reelection. That pledge may give him a tax cut he can campaign on, but experts and critics warn that making such cuts permanent would weaken the finances of Social Security. “He is putting Social Security at grave risk at a time when seniors are suffering the overwhelming impact of a pandemic he has failed to get under control,” Joe Biden, the presumptive Democratic presidential nominee, said. “He is laying out his roadmap to cutting Social Security.”

Mnuchin claimed Sunday that the suspension of payroll tax collections would not mean a reduction in benefits and that the shortfall in revenue to the Social Security Trust Fund would be made up by a transfer from the Treasury Department’s General Fund.

Eviction moratorium: The executive order addressing housing doesn’t reinstate an earlier moratorium on some types of evictions, which lapsed in July. Instead, it calls on the leaders of Health and Human Services and the Centers for Disease Control to “consider” whether such a ban is “necessary to prevent the further spread of COVID-19.”

Student loan deferral: Trump waived all interest and allowed people to delay payments on student loans held by the federal government through the end of the year.

What’s not covered by Trump’s actions: Trump’s actions don’t cover many of the other relief programs lawmakers had considered, including another round of $1,200 stimulus checks; funding for schools, election security and the U.S. Postal Service; an extension of the Paycheck Protection Program of loans to small businesses; and aid to state and local governments.

“The downside of executive orders is you can’t address some of the small business incidents that are there,” White House Chief of Staff Mark Meadows said. “You can’t necessarily get direct payments, because it has to do with appropriations. That’s something that the president doesn’t have the ability to do. So, you miss on those two key areas. You miss on money for schools. You miss on any funding for state and local revenue needs that may be out there.”

What’s next: Democrats responded to Trump’s actions by urging the White House to come back to the negotiating table and meet them halfway. Trump tweeted Monday that Schumer and Pelosi now want to make a deal and have his phone number, but Democrats said there’s been no contact with the White House since Friday. Mnuchin told CNBC that the White House was “prepared to put more money on the table,” to reach an agreement. “If we can get a fair deal, we’re willing to do it this week,” he said.

The bottom line: There are no talks scheduled and if negotiations don’t resume, Trump is making a pair of risky bets, given all the questions surrounding his executive actions. First, that the economy he desperately wants to recover in time for the November elections won’t be further damaged by the lack of a broader deal. Economists warn that more aid will be needed. And as Jim Tankersley of The New York Times suggests, if the aid doesn’t arrive and the economy does slump toward recession again, Trump may well be betting his political future on the idea “that it is better to tell voters he tried to help the economy than to have actually helped it.”

This article was updated on Tuesday, August 11.